Reported by FinCEN

(Excerpt shared below. To read full NPRM, go to: https://www.fincen.gov/system/files/2025-11/FinCEN-311-Gambling-Establishments-NPRM.pdf)

FinCEN has issued a sweeping Notice of Proposed Rulemaking that designates transactions involving ten Mexico-based gambling establishments as a primary money-laundering concern. Using its authority under Section 311 of the USA PATRIOT Act, the agency argues that these casinos have been systematically used to launder criminal proceeds tied to transnational organized crime. The proposed action would erect new, stronger barriers between these high-risk entities and the U.S. financial system.

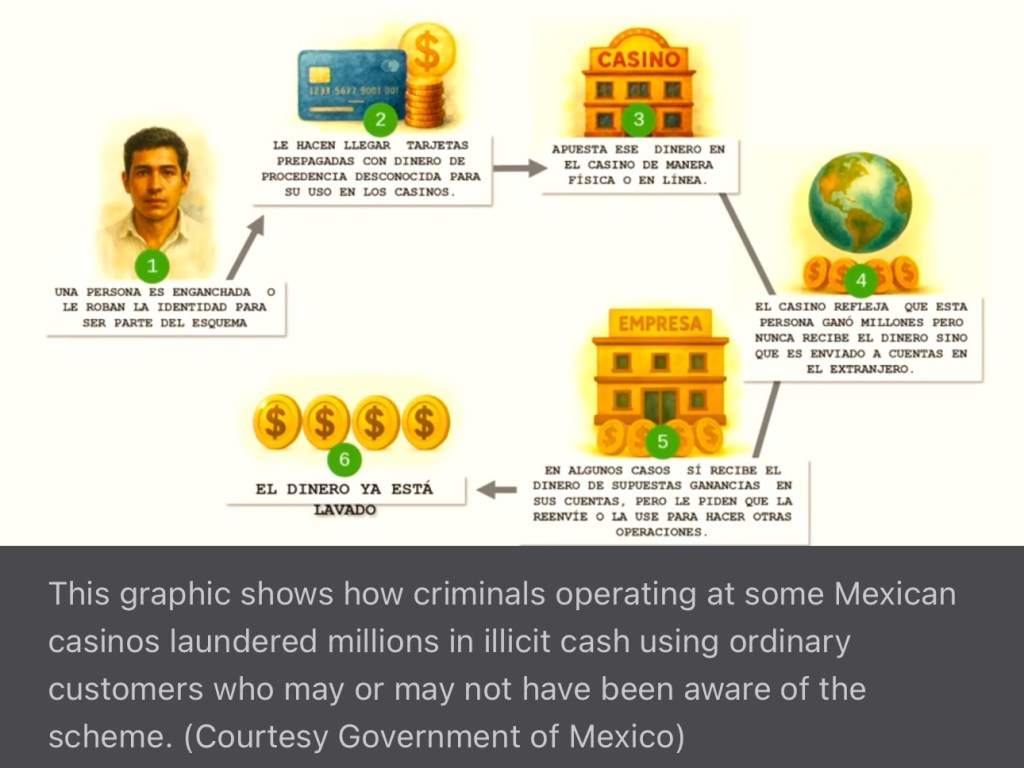

The NPRM identifies ten gambling establishments—operating across states such as Sonora, Sinaloa, Baja California, and Tabasco—that FinCEN says are linked to the financial operations of the Sinaloa Cartel. According to FinCEN’s analysis, the casinos have facilitated structured deposits, cash movements, and transaction layering designed to disguise the origin of illicit funds. Their operations allegedly enable cartel-connected actors to access the U.S. correspondent banking system indirectly through foreign banks.

To mitigate these risks, FinCEN proposes invoking Special Measure 5, the most restrictive tool available under Section 311. If adopted, U.S. banks, broker-dealers, and other covered financial institutions would be prohibited from opening or maintaining correspondent accounts for foreign banks that process transactions tied to the named establishments. Institutions would also be required to adopt enhanced due-diligence measures to ensure none of their existing foreign correspondent accounts are being used to route these transactions.

The rule outlines strict monitoring expectations, including notifying foreign correspondent account holders about the prohibition, implementing screening controls, and documenting compliance efforts. FinCEN emphasizes that while the measure is severe, it is targeted and consistent with existing risk-based frameworks used by institutions that handle foreign correspondent relationships.

FinCEN concludes by inviting public comment and forecasting minimal incremental burden for most U.S. institutions, since many already maintain robust correspondent-account oversight programs. Still, the proposal marks one of the most aggressive AML interventions in recent years—signaling heightened scrutiny on cross-border gambling activity and its intersection with major organized-crime networks.