Reported by Chirag Bhardwaj

(Summary shared below. For full report, go to: https://appinventiv.com/blog/blockchain-for-digital-identity-verification/)

Digital identity is the backbone of how individuals interact online, from logging into social media accounts to verifying identities for banking and tax services. Yet, the current centralized systems that manage digital identity are increasingly vulnerable to theft, fraud, and misuse. In the U.S., identity theft has become widespread, affecting one in three Americans annually. To address these risks, the U.S. Senate is advancing the Improving Digital Identity Act, which would create a task force to promote secure, interoperable, and privacy-focused digital identity solutions—potentially leveraging technologies such as blockchain, biometrics, and artificial intelligence.

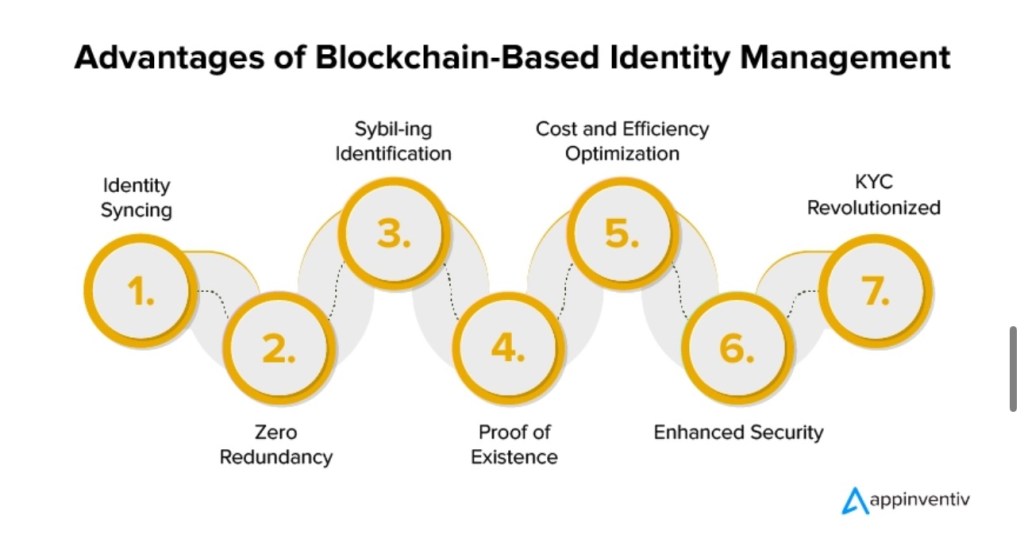

The flaws of legacy identity systems stem from their centralized nature. Individuals are required to repeatedly provide sensitive information across different platforms, multiplying the attack surface for hackers. Additionally, compliance processes like Know Your Customer (KYC) and Anti-Money Laundering (AML) are expensive and inefficient, costing large financial institutions tens of millions each year. Centralized databases also strip users of control, as personal data is often exploited for commercial purposes without meaningful consent or ownership.

Blockchain is emerging as a powerful alternative, offering decentralization, transparency, and cryptographic protections. Features such as zero-knowledge proofs, embedded encryption, and revocation rights empower users to control who can access their data, when, and under what conditions. This Self-Sovereign Identity (SSI) model places authority in the hands of individuals rather than intermediaries, reducing reliance on vulnerable centralized systems while enhancing privacy and trust.

The benefits of blockchain identity management extend across multiple industries. In healthcare, it can secure the transfer of medical records while protecting patient privacy. In financial services, it can streamline onboarding, compliance, and fraud prevention. Governments can leverage blockchain for secure voting, benefits administration, and reduced redundancy in citizen records. Even retail and eCommerce can apply blockchain identity verification to strengthen trust and authenticity in transactions.

Ultimately, blockchain represents more than a technological upgrade—it marks a paradigm shift in how digital identity is managed. By lowering costs, eliminating inefficiencies, reducing fraud, and giving individuals control over their data, blockchain-powered identity solutions could redefine trust in the digital world. While challenges remain in scaling and adoption, the move toward decentralized, user-owned identity systems signals a future where individuals are no longer passive participants but active custodians of their digital identities.