Reported by Alexander Verhagen, Angela Luget, Vasiliki Stergiou, Debanjan Banerjee, and Olivia Conjeaud

(Summary featured below. To read full report, go to: https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/how-agentic-ai-can-change-the-way-banks-fight-financial-crime#/)

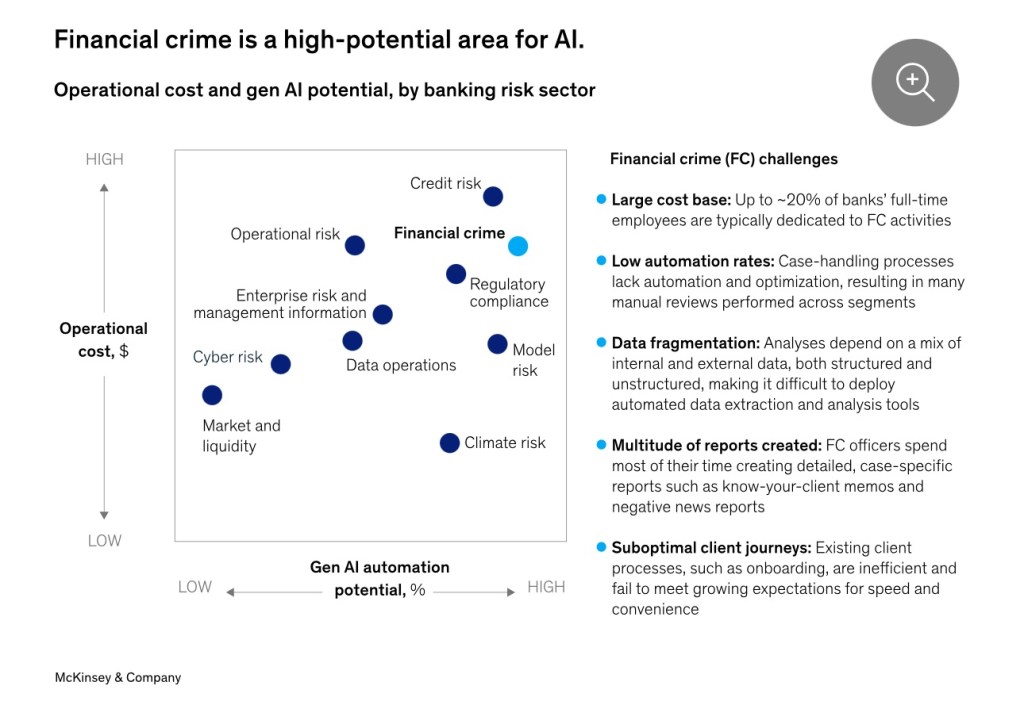

Banks are spending more than ever on know-your-customer (KYC) and anti-money-laundering (AML) compliance, but the return on investment remains alarmingly low. Interpol estimates that only around 2% of global financial crime flows are detected, despite annual compliance spending increasing by up to 10% in advanced markets between 2015 and 2022. Much of this underperformance stems from inefficiencies—fragmented data, unstandardized processes, and heavy manual workloads that consume 10–15% of bank staff. Customers, meanwhile, often face cumbersome onboarding and review experiences.

Artificial intelligence offers a way forward, but not all AI is created equal. The article distinguishes between three main types: analytical AI, generative AI, and agentic AI. Analytical AI improves detection accuracy, reduces false positives, and creates more dynamic risk models. Generative AI assists human investigators by extracting and summarizing data, drafting reports, and speeding up investigations. These technologies boost efficiency but typically still rely on human involvement for execution.

Agentic AI represents the next leap—autonomous AI “agents” that can perform end-to-end compliance tasks with minimal human intervention. These agents, working individually or in coordinated “squads,” handle activities such as KYC checks, transaction monitoring, sanctions screening, and fraud investigations from alert to closure. Humans step in only for oversight, exception handling, and complex decision-making. This shift can yield productivity gains between 200% and 2,000%, along with higher consistency and quality of outputs. Examples include retrieval agents for document analysis, data pipeline agents for monitoring data flows, and QA agents to ensure results meet compliance standards.

To deploy agentic AI effectively, banks must rethink their operating models and lay strong foundations. Key principles include redesigning entire customer journeys, mirroring human team structures with AI roles, embedding quality control in every AI squad, and limiting manual intervention to the most complex cases. The transformation also depends on six enablers: skilled people, clearly mapped processes, scalable technology, high-quality data, robust risk management, and comprehensive change management. Without these pillars, AI risks automating flawed processes or creating new compliance gaps.

The path to adoption starts small but must scale fast. Leading banks begin with a pilot focused on a defined customer segment, prove the model’s impact, and then expand. Success depends on speed of adoption, continuous improvement, and maintaining AI capabilities over time. For institutions willing to commit, agentic AI offers the potential to revolutionize financial crime prevention—delivering stronger compliance, lower costs, better customer experiences, and a competitive edge in an increasingly complex risk landscape.