Reported by by Fenergo and PwC

The whitepaper “Target Operating Models That Work: From Vision to Value” by Fenergo and PwC presents a detailed framework for designing and executing effective Target Operating Models (TOMs) in financial institutions, particularly to strengthen Client Lifecycle Management (CLM), AML compliance, and operational agility. It emphasizes that TOMs should not be treated as IT projects but as strategic control frameworks that bring people, data, and technology into alignment. Without shared vision and stakeholder buy-in, even sophisticated systems can fall short in delivering business value and regulatory compliance.

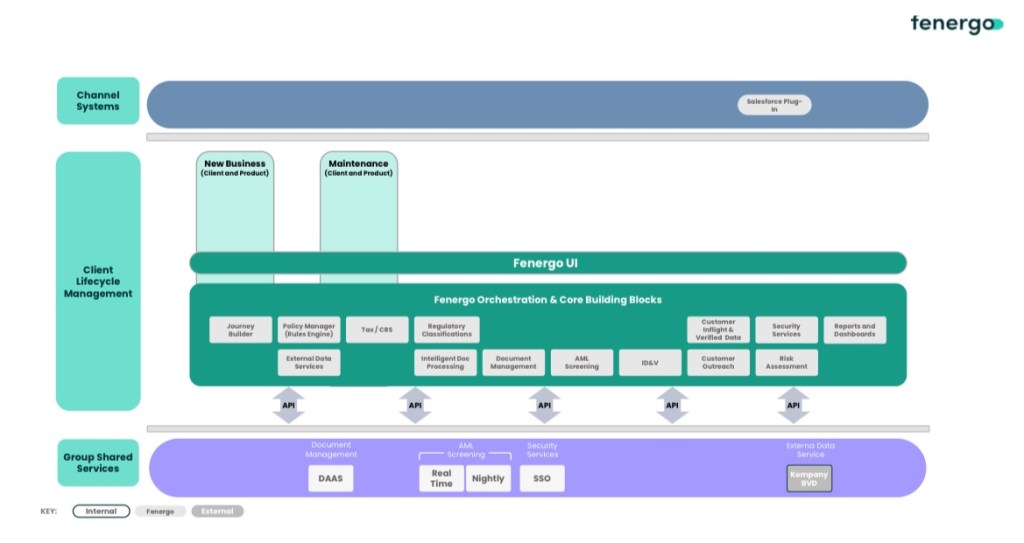

The paper stresses the need for alignment and collaboration across domains such as client experience, compliance, technology, and operations. A well-designed TOM ensures streamlined workflows, empowers teams with clarity of ownership, and fosters trust and accountability. The importance of a phased transformation approach is underlined—starting with foundational use cases like onboarding, expanding to include broader workflows, and eventually scaling across the enterprise with confidence and resilience.

Data is highlighted as the central engine of TOM success. Clean, connected, and trusted data underpins effective CLM and compliance. Institutions with poor data governance face operational inefficiencies, regulatory risks, and client dissatisfaction. The paper argues that financial institutions must treat data as a strategic asset, invest in master data management (MDM), and prioritize data quality, lineage, and governance from the outset to realize the full potential of their transformation initiatives.

In the execution phase, the paper warns against de-scoping features to accelerate timelines, as this undermines long-term value and control integrity. It advocates for strong execution governance and outcome-based accountability. Most failed transformations occur not from poor planning, but from rushed or poorly governed execution. Success demands discipline, cross-functional alignment, and a focus on both speed and sustainability in delivery.

Finally, TOMs must be continuously maintained and improved, not treated as static frameworks. As regulatory environments evolve and client expectations rise, firms must revisit and refine their operating models. A mature TOM embeds measurement, governance, and flexibility, ensuring firms remain compliant, client-centric, and capable of scaling effectively. The whitepaper concludes by positioning TOMs as essential for enabling future-ready financial institutions that can deliver resilience, trust, and competitive growth in a dynamic regulatory landscape.