Reported by Global Financial Integrity

(Summary featured below. To read full report, go to: https://insightcrime.org/wp-content/uploads/2025/07/GFI-BO-Report-2025-english.pdf)

As global transparency standards evolve, beneficial ownership (BO) registries have become critical tools in the fight against financial crimes. The latest report by Global Financial Integrity (GFI), published in June 2025, offers a sweeping analysis of the current state, challenges, and future directions of BO registries across 38 jurisdictions in Latin America and the Caribbean (LAC). These registries are essential for identifying the true individuals behind companies and legal structures, helping countries comply with international standards from FATF, OECD, and others while combating money laundering, tax evasion, and corruption.

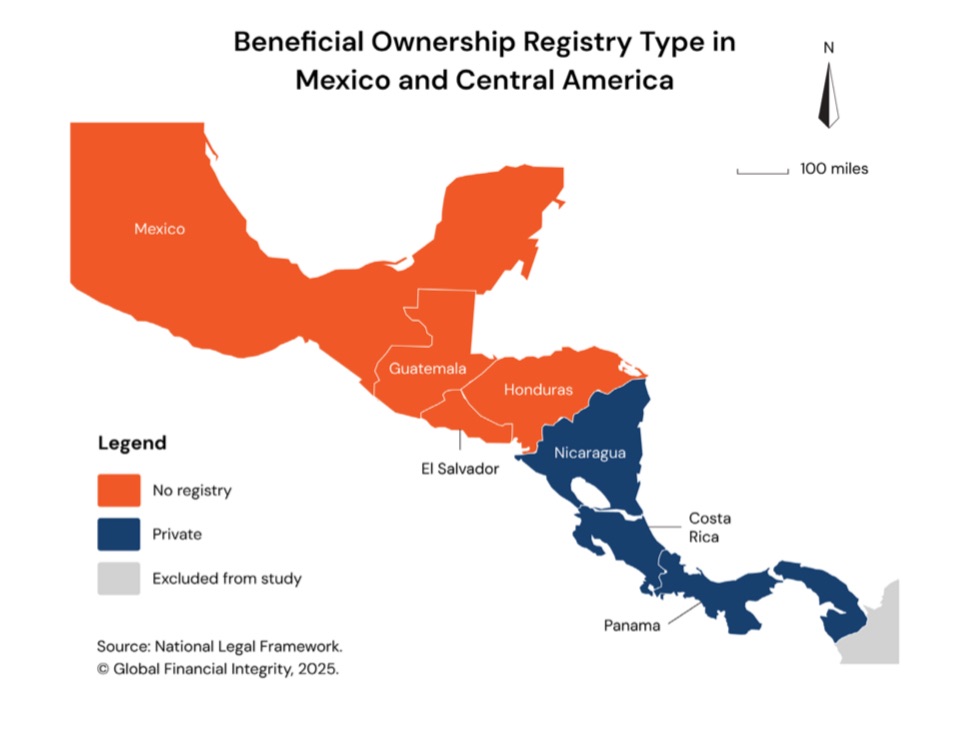

The report highlights how many LAC nations have adopted a “registry approach” to BO transparency, focusing on centralized, legally mandated data collection. Yet, implementation varies widely. While countries like Costa Rica and Panama have built robust centralized registries, others like Mexico and Suriname still lack cohesive frameworks. A key divide remains around access: some registries are public, others are private, and a growing number operate on a “legitimate interest” basis, granting access to vetted stakeholders such as journalists and civil society groups. The debate over privacy versus transparency continues to shape policy decisions across the region.

Case studies from Belize and Colombia illustrate both progress and growing pains. Belize, for instance, launched a private online BO registry aligned with FATF guidelines but struggles with public access and enforcement. Colombia’s “Registro Único de Beneficiarios Finales” represents a strong institutional effort, yet it faces challenges in data verification and cross-agency coordination. Meanwhile, in the Caribbean, British Overseas Territories like the Cayman Islands and Bermuda have begun shifting toward greater transparency, allowing limited public access to their registries under legitimate interest models.

A major influence on regional policy is the shifting regulatory landscape in the United States. The Corporate Transparency Act, which mandates BO reporting to FinCEN, has faced legal and political setbacks, including a temporary suspension of enforcement under the Trump administration in early 2025. These developments may dampen momentum in LAC countries where U.S. leadership on transparency has often served as a reference point. Likewise, a 2023 EU court ruling weakening public access requirements in Europe adds to the uncertainty, challenging international consensus on BO openness.

Ultimately, GFI’s report emphasizes that while significant strides have been made, beneficial ownership transparency in the LAC region remains fragmented. The report calls for harmonized thresholds, improved verification, integration of BO data into procurement processes, and regional cooperation through platforms like CARICOM. As global financial crime becomes more sophisticated, strengthening BO frameworks is not just a matter of compliance—but a fundamental step toward equitable, transparent governance in the region.