Reported by Chainalysis

(Excerpt featured below. To read full report, go to: https://www.chainalysis.com/blog/huione-guarantee-still-active-despite-shutdown/)

Following the takedown of its website, Telegram channels, and an officially announced closure, activity linked to the illicit Chinese-language marketplace Huione has not declined — in fact, it has increased. Our data shows that the platform continues to process billions of dollars worth of transactions, pointing to a highly resilient system that operates largely independent of its public-facing infrastructure.

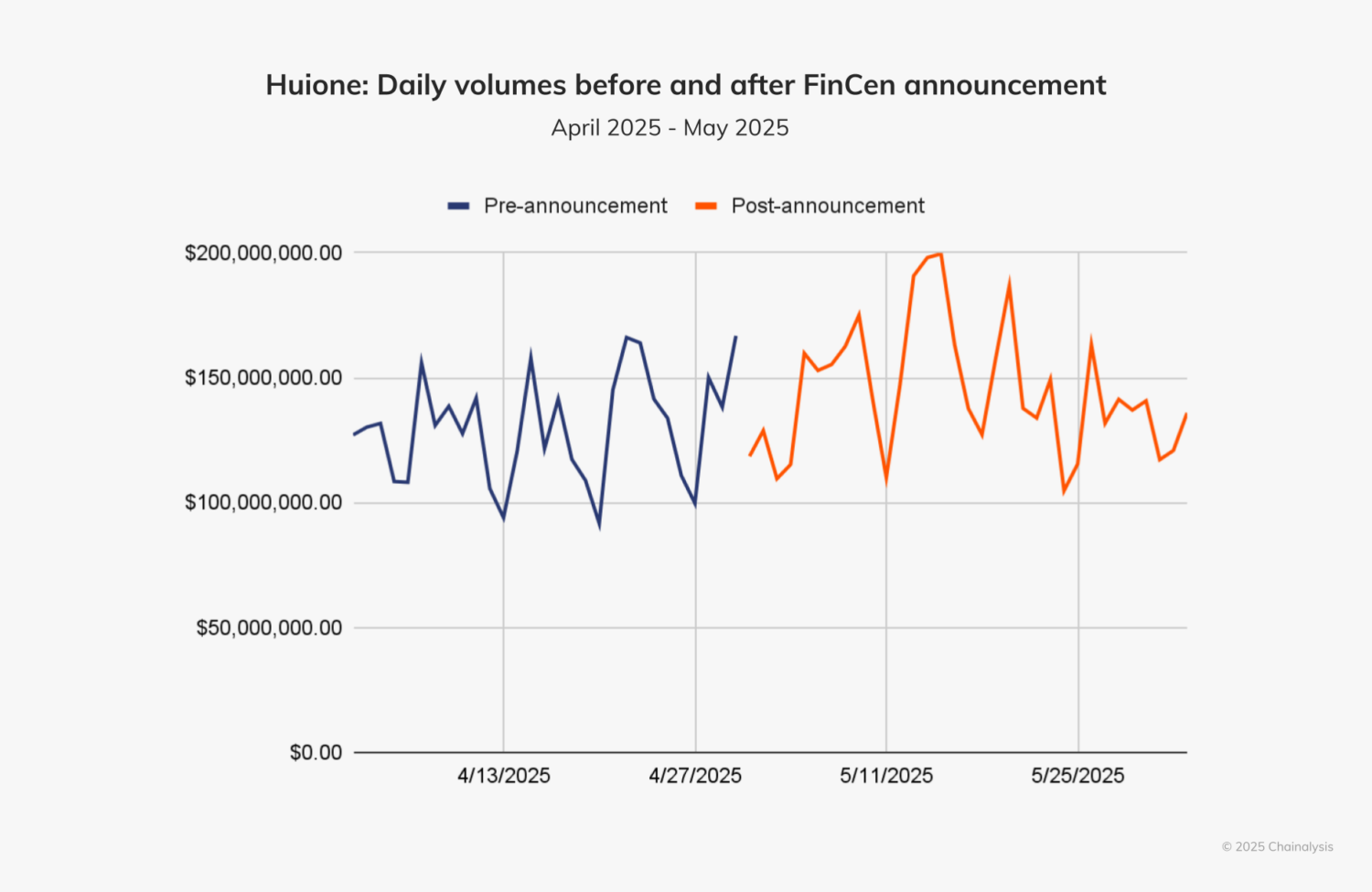

On May 1, 2025, FinCEN moved to designate Cambodia-based Huione as a primary money laundering concern under Section 311 of the USA PATRIOT Act. If finalized, the move would cut Huione off from the U.S. financial system. Yet transaction volumes remain largely unaffected.

Huione’s continued operations reflect broader trends in Chinese-language laundering networks, particularly those built around “guarantee services.” Huione’s ability to function at scale with a complex infrastructure suggests a shift toward more decentralized, embedded financial systems designed to evade conventional disruption. Addressing these networks may require updated enforcement strategies that go beyond surface takedowns and focus on the complex underlying architecture that supports them.

Impact of FinCEN designation: Huione continues to launder funds at scale

This represents FinCEN’s second use of Sections 311 and 9714 against crypto-linked illicit finance, following actions against the Bitzlato exchange. The approach offers regulatory advantages: Section 311 measures can isolate bad actors without immediate judicial scrutiny, as they’re framed as protective rules rather than asset freezes.

While the rule is pending finalization, U.S. banks typically react immediately to Section 311 proposals, often severing ties upon announcement to avoid regulatory risk. This “de-risking” effect means Huione likely lost U.S. dollar access from the day of the notice — yet transactional data suggests minimal operational impact.

The data shows that not only did transaction volume not drop following the FinCEN announcement, it actually increased. While it is too early to determine the long-term effects, this early trend demonstrates the platform’s – and the guarantee ecosystem’s – operational resilience are a reflection of their complex laundering networks, which generally avoid mainstream exchanges subject to U.S. jurisdiction.