Reported by The U.S. Department of the Treasury

(Excerpt shown below. To read full report, go to: https://home.treasury.gov/news/press-releases/sb0159.)

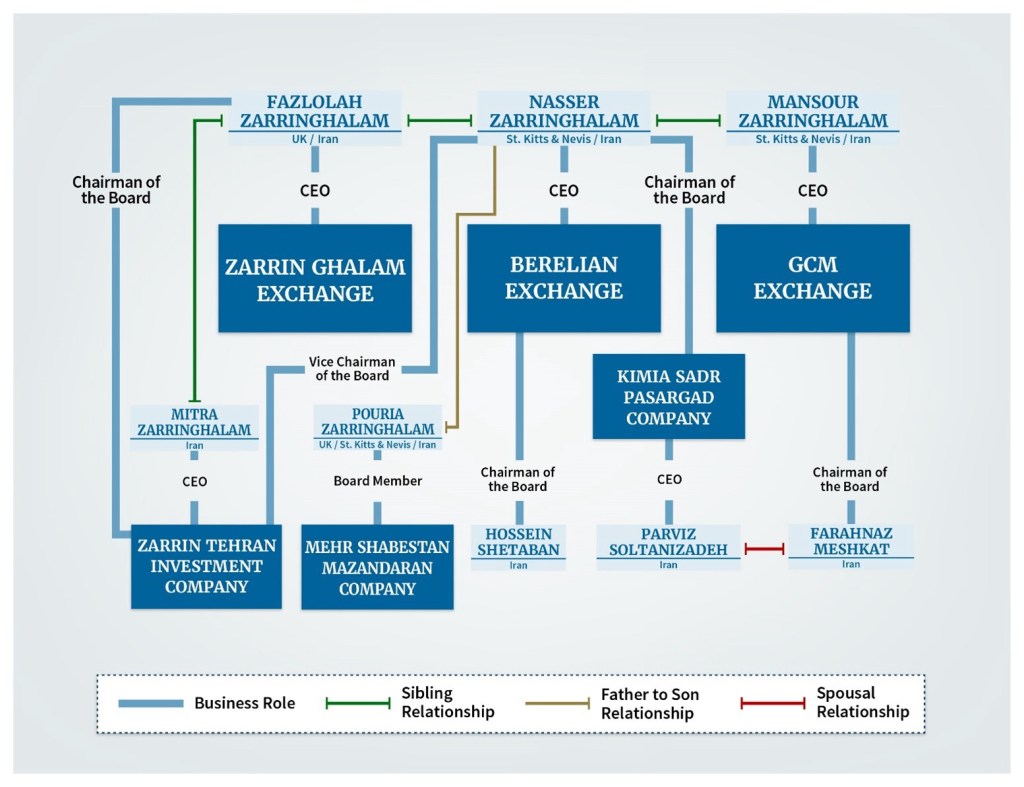

On June 6, 2025, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) designated over 30 individuals and entities tied to Iranian brothers Mansour, Nasser, and Fazlolah Zarringhalam, who have collectively laundered billions of dollars through the international financial system via Iranian exchange houses and foreign front companies under their control as part of Iran’s “shadow banking” network. The regime leverages this network to evade sanctions and move money from its oil and petrochemical sales, which help the regime fund its nuclear and missile programs and support its terrorist proxies. Concurrently, Treasury’s Financial Crimes Enforcement Network (FinCEN) is issuing an updated Advisory to assist financial institutions in identifying, preventing, and reporting suspicious activity connected with Iranian illicit financial activity, including oil smuggling, shadow banking, and weapons procurement.

“Iran’s shadow banking system is a critical lifeline for the regime through which it accesses the proceeds from its oil sales, moves money, and funds its destabilizing activities,” said Secretary of the Treasury Scott Bessent. “Treasury will continue to leverage all available tools to target the critical nodes in this network and disrupt its operations, which enrich the regime’s elite and encourage corruption at the expense of the people of Iran.”

This action is being taken pursuant to Executive Order (E.O.) 13902, which targets Iran’s financial and petroleum and petrochemical sectors, and E.O. 13846, and is the first round of sanctions targeting Iranian shadow banking infrastructure since the President issued National Security Presidential Memorandum 2, directing a campaign of maximum pressure on Iran.

SHADOW BANKING: THE REGIME’S CLANDESTINE AND CORRUPT SCHEME

Iran’s shadow banking networks, comprised of numerous financial facilitators like the Zarringhalam brothers, allows sanctioned Iranian persons and military organizations to access the international financial system and facilitate Iran’s international exports, the proceeds of which fund Iran’s military and its terrorist proxies. The system operates as a parallel banking system in which settlements are brokered through Iran-based exchange houses that use front companies outside of Iran, primarily located in Hong Kong and United Arab Emirates (UAE), to make or receive payments on behalf of sanctioned persons in Iran. To justify payments for sanctioned goods, shadow banking brokers may generate fictitious invoices or transaction details. Front companies are created in jurisdictions with lower levels of regulatory supervision so that they can avoid scrutiny of their business practices or ownership. The shadow banking system negatively impacts the Iranian people as well; Iranian whistleblowers have highlighted instances of Iranian government agents embezzling billions of dollars and other acts of corruption through this banking network.