Reported by FinCEN

(Summarized version featured below – full version available at the end of the summary)

The 2024 Financial Trend Analysis (FTA) report by FinCEN highlights the growing threat of fentanyl-related illicit finance, drawing from 1,246 Bank Secrecy Act (BSA) reports that flagged approximately $1.4 billion in suspicious transactions. These transactions reveal the extensive integration of the U.S. financial system into the global fentanyl trade. Mexican cartels—especially the Sinaloa Cartel and Cartel Jalisco Nueva Generacion (CJNG)—work closely with precursor chemical suppliers in the People’s Republic of China (PRC), often using intermediaries and e-commerce platforms to facilitate payments and distribution. The report emphasizes how money services businesses (MSBs) and depository institutions in the U.S. play a central role in these illicit financial flows.

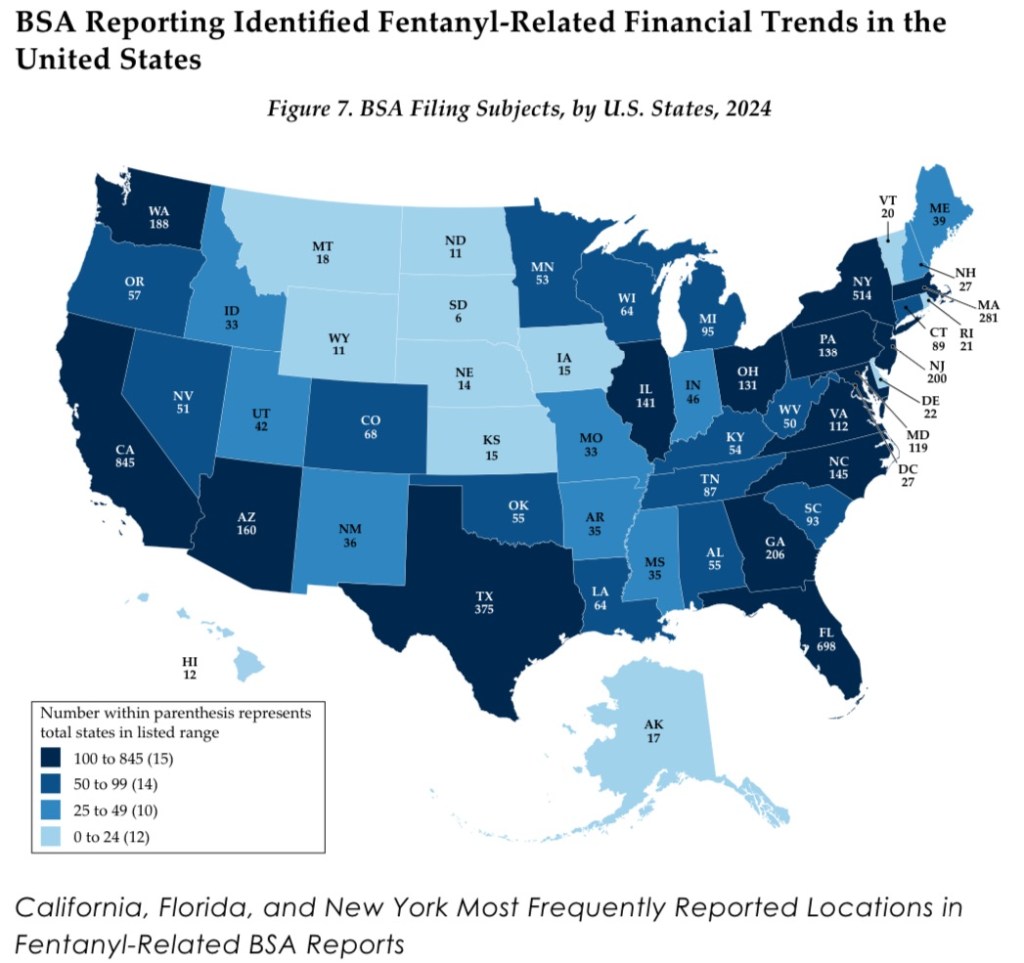

Geographic trends underscore how fentanyl-related financial activity spans multiple countries and U.S. states. Mexico and the PRC are the most frequently cited foreign jurisdictions, with significant activity also noted in Canada, the Dominican Republic, and India. Within Mexico, Sinaloa and Jalisco dominate the BSA reporting, while in the U.S., states like California, Florida, and New York report the highest number of subjects. Notably, BSA filings connect precursor chemical transactions to key “plaza” towns near the U.S.-Mexico border, emphasizing the strategic placement of trafficking routes. U.S.-based fentanyl distribution frequently involves cash transactions and peer-to-peer (P2P) platforms, with drug-related euphemisms in payment memos assisting financial institutions in flagging suspicious behavior.

The report describes a range of laundering methods used to disguise fentanyl proceeds, from basic remittances through MSBs to sophisticated trade-based money laundering (TBML) and professional money laundering organizations (PMLOs). Chinese and Mexican PMLOs—sometimes involving couriers with Chinese passports—use shell companies, mirror transfers, and cross-border purchases (e.g., electronics and vape devices) to obscure transaction trails. These operations are often aided by online platforms and anonymized digital finance systems such as convertible virtual currency (CVC), primarily Bitcoin, which appear in both darknet marketplace transactions and payment streams tied to precursor chemicals.

Finally, FinCEN highlights the evolving role of e-commerce and digital communication in supporting the fentanyl trade. PRC-based suppliers advertise chemicals using coded language, Chemical Abstracts Service (CAS) numbers, and promises of customs clearance, while U.S.-based intermediaries and “straw buyers” conduct wire transfers and online payments. This layered structure of front companies, shell corporations, and criminal logistics networks—often operating across continents—demonstrates the fentanyl trade’s adaptability and the need for sustained financial intelligence to support enforcement efforts. The report ends by inviting financial institutions to contribute feedback and intelligence to enhance the national response to this crisis.

Read full report attached below: