Reported by Selam Gebrekidan and Joy Dong

(Summarized version featured below)

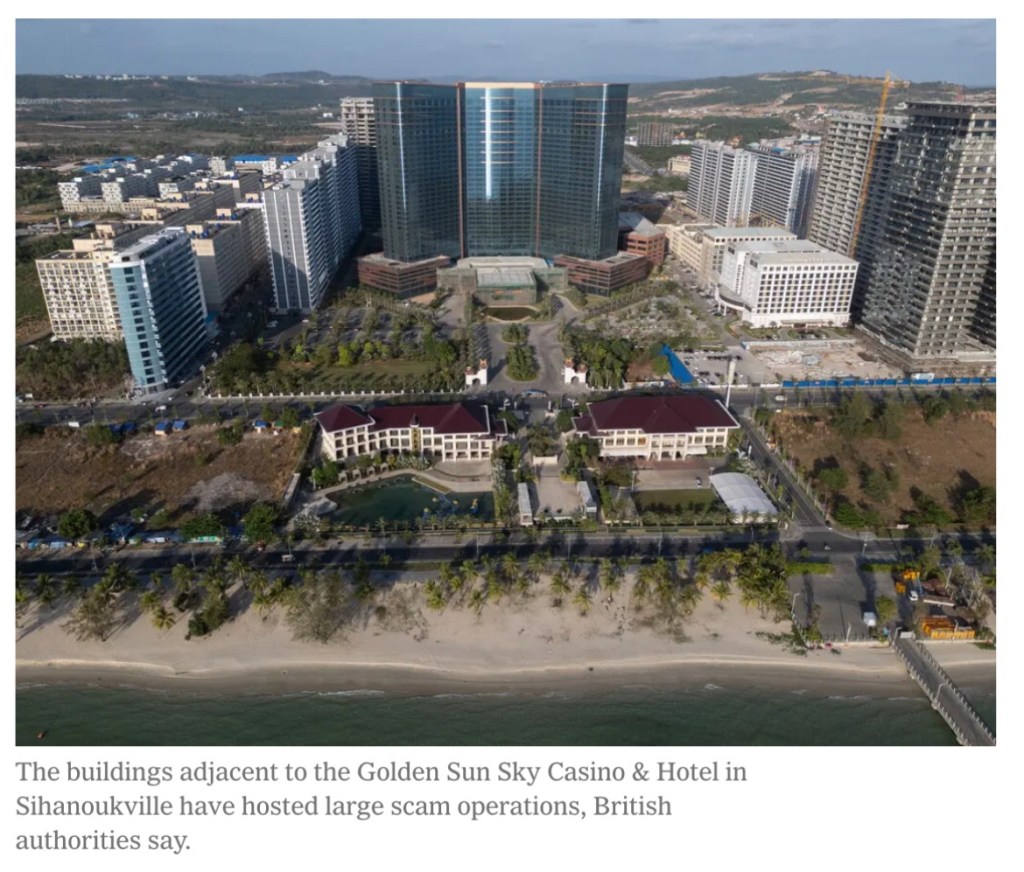

The article exposes a vast and sophisticated money-laundering network that enables online scammers to steal billions of dollars and funnel the funds into the global economy. Based in Cambodia, this illicit operation thrives in cities like Phnom Penh and Sihanoukville, where fraudsters operate from call centers and fortified compounds. Despite efforts by law enforcement agencies like the FBI, Interpol, and China’s Ministry of Public Security, these scams persist due to an efficient laundering system that quickly erases the origins of stolen money. The network is so adaptable that even when governments crack down on it in one region, it resurfaces elsewhere.

At the heart of this operation are “matchmakers,” intermediaries who facilitate the movement of stolen funds through “money mules”—people or shell companies that hold bank accounts and cryptocurrency wallets. Once scammers trick victims into transferring money, mules move it through a complex series of transactions, often converting it into cryptocurrency. The matchmakers take a cut of the stolen funds, ensuring that scammers receive the majority of their ill-gotten gains while maintaining a layer of protection against detection. This process makes the illicit funds appear legitimate, allowing them to enter the formal banking system undetected.

A major facilitator of this underground economy is Huione, a financial conglomerate that hosts an online marketplace where scammers connect with money launderers. Using Telegram chat groups with hundreds of thousands of members, criminals openly advertise laundering services. Huione denies involvement in illegal activities, but its affiliates provide escrow services to prevent fraud among scammers and enable seamless transactions. The cost of laundering money varies depending on the crime and location, with stricter enforcement in countries like China driving up fees. Even when authorities shut down channels, new ones emerge almost instantly.

Money mules play a crucial role in the laundering process but face the highest legal risks. They use fake identities and multiple accounts to avoid detection, keeping transactions below regulatory thresholds. A U.S. case involving Daren Li illustrates how mules operate, moving millions of dollars through shell companies and offshore banks before converting funds into cryptocurrency. While Li’s arrest highlighted the role of Huione in these schemes, authorities struggle to dismantle the larger network, as new players quickly replace those caught. The Cambodian government claims to be improving financial oversight, but enforcement remains weak.

Beyond individual scammers, these criminal enterprises function like legitimate corporations, employing thousands of workers, many of whom are victims of human trafficking. Employees receive wages only after meeting quotas, and their salaries fuel local economies, from restaurants to casinos and brothels. AI-generated deepfake videos, stolen personal data, and sophisticated tech infrastructure support these scams, ensuring a steady stream of victims. In the end, some of the stolen money is used to buy luxury goods and real estate, while the rest funds the fireworks displays that celebrate yet another successful heist.

Read full version: https://www.nytimes.com/2025/03/23/world/asia/cambodia-money-laundering-huione.html