Reimagining KYC to Meet Regulatory Scrutiny

Reported by Suparna Goswam

(Summary version featured below)

Banks are struggling to keep up with evolving Know Your Customer (KYC) requirements, as outdated processes create compliance gaps and increase regulatory scrutiny. In the first half of 2024, KYC-related fines more than doubled to $51 million, with major banks facing significant penalties for failures in anti-money laundering (AML) controls. Regulators are pushing for automation and real-time data integration, making the shift toward “perpetual KYC” increasingly urgent. Unlike traditional KYC, which relies on periodic reviews, perpetual KYC enables continuous monitoring and immediate risk assessment.

Traditional KYC models assess customer risk at onboarding and at fixed intervals—often years apart—leaving dangerous gaps where fraud or illicit activity can go undetected. Experts warn that high-risk customers can continue transacting freely until their next scheduled review, increasing financial crime risks. Banks are now detecting risk level changes overnight due to factors such as suspicious transactions or updates to sanctions lists. Real-time monitoring, adaptive risk models, and automated KYC updates are seen as essential for early fraud detection and compliance.

A more effective KYC process requires banks to go beyond basic customer data collection and tailor risk assessments to specific financial products. Experts advocate for integrating external data sources such as credit reports, sanctions lists, and adverse media reports to identify inconsistencies and red flags. AI and machine learning (ML) can help automate KYC monitoring, reducing the need for manual reviews and allowing fraud teams to focus on high-priority investigations. However, many banks have yet to fully adopt AI-driven KYC, leaving them vulnerable to sophisticated fraud tactics.

Despite AI’s potential, integrating perpetual KYC into legacy banking systems remains a challenge. Many banks rely on outdated or fragmented databases, which can lead to inaccurate risk assessments and customer friction. Experts emphasize the need for high-quality data and optimized AI models to improve detection accuracy. Rather than replacing existing systems entirely, banks should focus on training AI models on their own data and running parallel testing to refine risk assessments. Without these steps, AI-driven KYC solutions may not deliver their full potential.

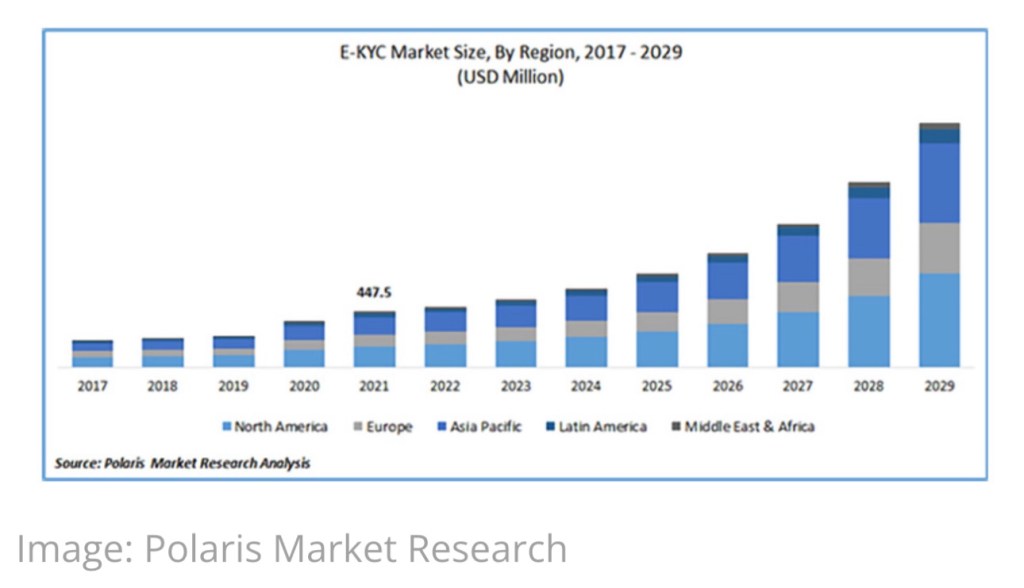

The KYC technology market is expanding rapidly, with projected growth rates ranging from 16.8% to 22% by 2029. Over 220 startups are currently operating in the KYC software space, with an average of 17 new companies launching annually. Future advancements will focus on regulatory compliance, data security, automation, and AI-driven enhancements. While the tools for perpetual KYC exist, the biggest challenge remains the speed at which financial institutions can adopt and implement these solutions to stay ahead of evolving financial crime risks.

Read original version: https://www.bankinfosecurity.com/reimagining-kyc-to-meet-regulatory-scrutiny-a-27449