Reported by U.S. Department of Justice

To download full report, go to link below:

(Summary version featured below)

Justice Department’s Fraud Crackdown in 2024 Sets Records for Prosecutions and Corporate Penalties

Washington, D.C. — The Justice Department’s Fraud Section recorded a banner year in 2024, securing an unprecedented number of convictions and corporate resolutions as it intensified its crackdown on white-collar crime. According to the department’s Fraud Section Year in Review report released in January 2025, federal prosecutors charged 234 individuals and secured 252 convictions, while corporate penalties soared to more than $2.3 billion—triple the total from the previous year.

The surge in enforcement reflects the department’s focus on prosecuting large-scale fraud schemes, particularly those involving corporate executives, government contractors, and health care providers. More than 35 percent of those charged were company executives or medical professionals, the report said, underscoring a shift toward holding high-level decision-makers accountable.

In addition to its domestic efforts, the Fraud Section expanded its global reach, securing resolutions with corporations based in China, Germany, Brazil, and South Africa. Cases spanned industries ranging from telecommunications and defense contracting to investment banking and cryptocurrency. “This past year demonstrated our commitment to combating fraud on a global scale,” said Glenn Leon, chief of the Fraud Section.

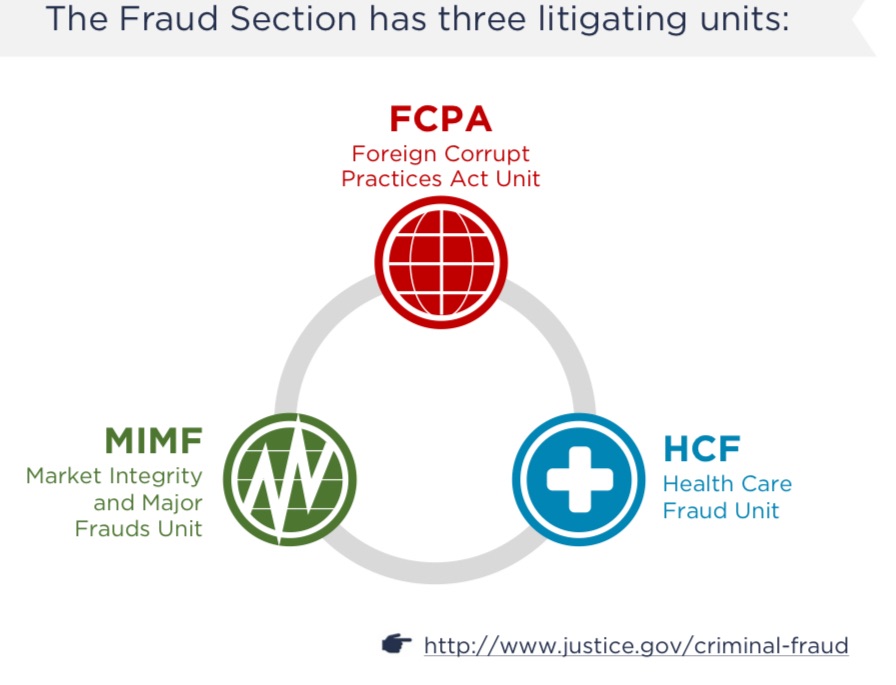

The department’s anti-corruption efforts were led by its Foreign Corrupt Practices Act (FCPA) Unit, which pursued corporate bribery cases involving some of the world’s largest companies. SAP SE, a Germany-based software giant, agreed to pay more than $220 million in penalties for bribing officials in South Africa and Indonesia. Swiss commodities trader Gunvor SA pleaded guilty to violating U.S. anti-bribery laws and agreed to a $661 million settlement. Other companies, including Raytheon and McKinsey Africa, also faced penalties for allegedly engaging in illicit payments to foreign officials.

Health care fraud also remained a top priority. The department charged 147 individuals in cases involving more than $3.26 billion in fraudulent claims to Medicare, Medicaid, and other government programs. In one of the largest cases of the year, authorities uncovered a $1.2 billion scheme involving fraudulent billing for wound care treatments. In another case, a Houston-based network of “pill mill” pharmacies was accused of illegally distributing more than 70 million opioid pills.

The Market Integrity and Major Frauds Unit focused on financial crimes, securing $1.7 billion in corporate resolutions. Investigators targeted securities fraud, market manipulation, and cryptocurrency schemes, often working alongside the Securities and Exchange Commission and the Commodity Futures Trading Commission.

To strengthen its enforcement efforts, the department launched the International Corporate Anti-Bribery (ICAB) initiative, designed to enhance cooperation with foreign law enforcement agencies. The initiative has already led to case referrals and coordinated resolutions, including the department’s first-ever joint settlement with Ecuadorian authorities.

Federal prosecutors also leaned on advanced data analytics to detect fraud, particularly in health care and financial markets. A dedicated team of data analysts helped identify suspicious billing patterns, leading to the indictment of a Texas-based laboratory accused of a $335 million Medicare scam. Officials say the expanded use of technology has allowed them to stay ahead of increasingly sophisticated fraud schemes.

As the Fraud Section enters its 70th year, officials say they expect enforcement efforts to intensify in 2025. “We’re holding corporations and individuals accountable like never before,” Leon said. “The message is clear: fraud at any level will not be tolerated.”