Reported by Wolfsberg Group

For full report, click here:

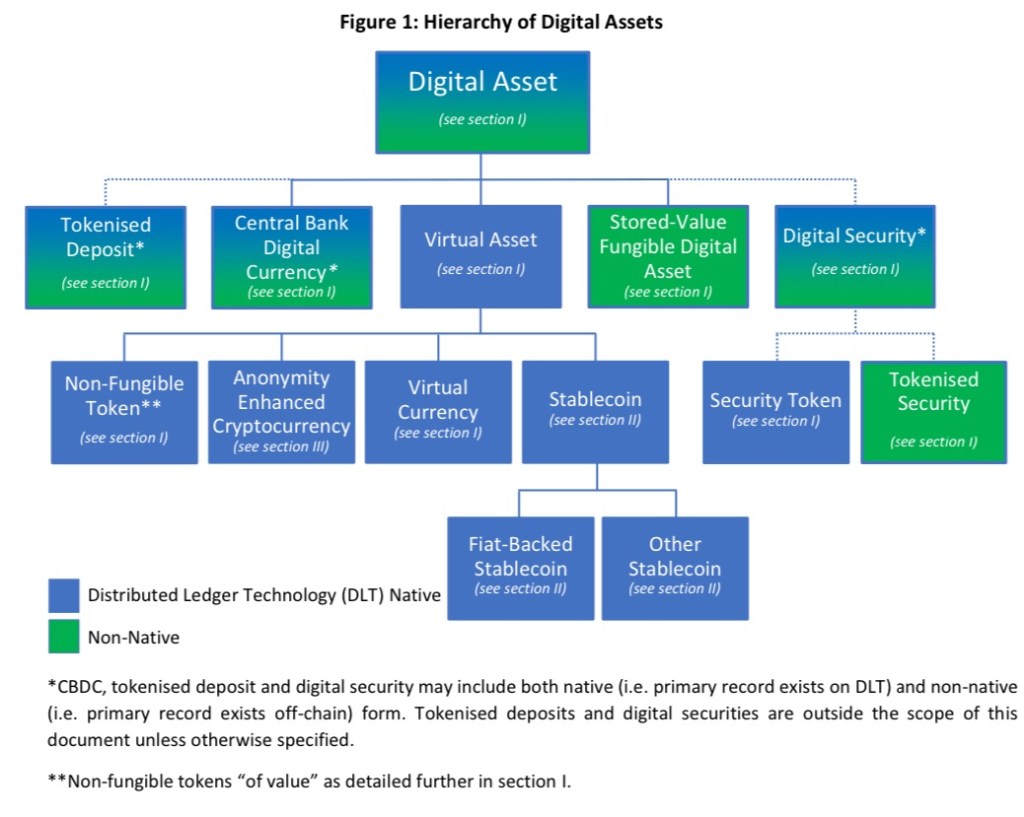

The Wolfsberg Group’s document highlights the necessity of defining digital assets to address the growing complexities and risks, particularly regarding money laundering and terrorism financing (ML/TF). These definitions help financial institutions, policymakers, and regulators understand asset characteristics, assess risks, and implement appropriate controls. Digital assets are described as cryptographically secured representations of value or rights, encompassing various forms. For instance, virtual assets like stablecoins are pegged to fiat currencies or other assets to maintain stability, while central bank digital currencies (CBDCs) serve as government-backed digital legal tender. Non-fungible tokens (NFTs) of value are included when they retain market tradability, and anonymity-enhanced cryptocurrencies like Monero introduce heightened ML/TF risks. By providing clarity, the Wolfsberg Group aims to foster consistent regulatory approaches and improve risk management practices.