Reported by Ron Shevlin

The New Director Should Remake the CFPB

The bureau—which one industry insider (who, not surprisingly, prefers to go unnamed) calls the Center For Punishing Banks—needs a complete overhaul.

The root of the CFPB’s ineffectiveness is that it believes that the way to fix the banking industry’s problems is to regulate.

To be effective, the CFPB must innovate, not regulate.

In order to remake the bureau, step one for the new director should be to fire all the lawyers (don’t feel bad for them—they’ll find new, higher paying jobs) and replace them with technologists and fraud/risk management experts.

Step two should be to address the root of the fraud/scam/cybersecurity problem, not the symptoms, as the bureau recently did with its lawsuit against the big banks that run Zelle, the person-to-person (P2P) payment tool.

As Ken Palla, a former banker who managed online security threat analysis and implemented security solutions, points out:

“Zelle has some of the lowest fraud/scam losses for a P2P service. In 2023, with $806 billion in transaction amounts, the fraud and scam losses totaled an estimated $400 million.”

Palla gets to the heart of why the CFPB needs a makeover:

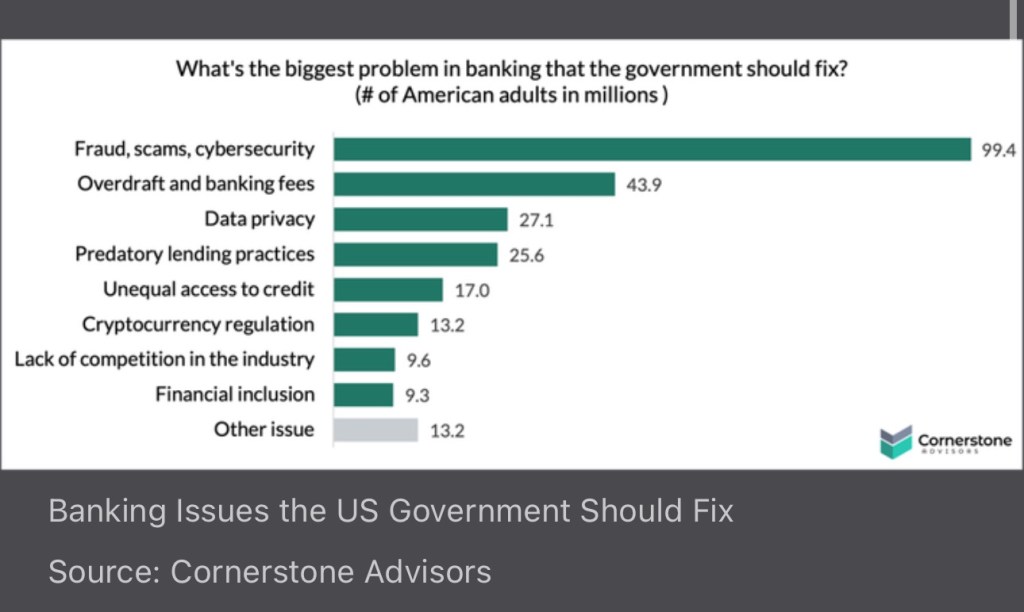

“Where the CFPB should be focused is creating a US government response to this massive consumer financial scam problem. The government needs to be involved because these scams are initiated and controlled by transnational criminal organizations and by nation states.”

Read full report: https://www.forbes.com/sites/ronshevlin/2025/01/02/its-time-to-remake-the-cfpb-into-the-consumer-fraud-protection-bureau/