Reported by Basel Institute on Governance

Download full report:

The 2024 Basel Anti-Money Laundering (AML) Index Report highlights global risks associated with money laundering and financial crimes. This independent report, produced by the Basel Institute on Governance, evaluates 164 countries and jurisdictions based on vulnerability to money laundering and related threats. The methodology incorporates 17 indicators spanning five domains: AML legal frameworks, corruption, financial transparency, public accountability, and political/legal risks. This year’s report also introduces fraud as a key factor, reflecting its growing relevance as a predicate crime for money laundering.

A central finding is the increased integration of fraud-related risks into the Index, elevating the average risk scores for countries, especially high-income nations with substantial financial centers. Fraud’s inclusion underscores its cross-border nature and its links to cybercrimes and organized criminal activities. Challenges remain in defining and collecting data on fraud due to the absence of global standards. This addition aims to encourage governments and financial institutions to refine their frameworks for combating fraud alongside traditional AML measures.

The report notes mixed progress in global compliance with AML standards. While technical compliance with the Financial Action Task Force (FATF) recommendations has improved by 12 percentage points since 2013, the effectiveness of AML measures globally remains low, at 28%. Key shortcomings include weak enforcement mechanisms, inadequate use of financial intelligence, and poor confiscation of criminal assets. These gaps indicate that while countries have formalized AML systems, practical enforcement remains insufficient.

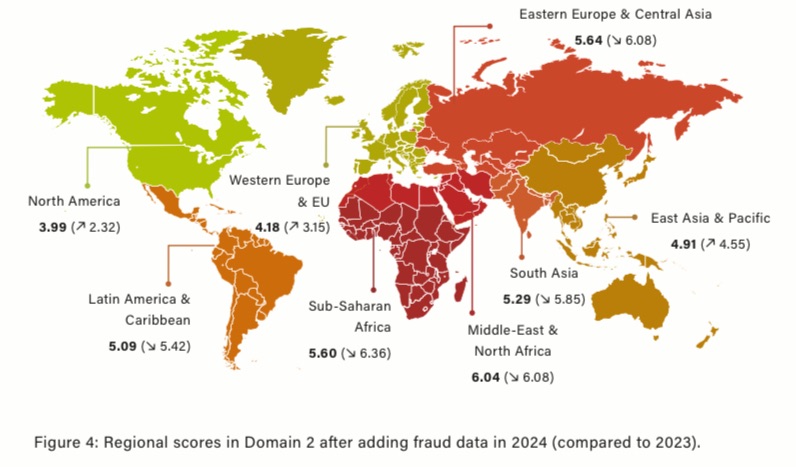

A regional analysis shows significant disparities in AML risks. Sub-Saharan Africa and parts of Asia face the highest vulnerabilities, driven by weak institutional frameworks and high corruption levels. Conversely, Western Europe and North America, despite robust frameworks, see rising risks in fraud and financial transparency. The FATF grey-listing process, often criticized, is presented as a tool for catalyzing reform in countries with identified deficiencies. Grey-listed countries are encouraged to address strategic weaknesses, with notable successes in jurisdictions that rapidly improved their AML frameworks.

Ultimately, the report emphasizes that AML efforts should extend beyond compliance to focus on societal outcomes such as peace, justice, and development. A comprehensive, multi-dimensional approach involving public transparency, political accountability, and financial sector cooperation is critical to addressing the complex global challenges posed by money laundering and related financial crimes.