Reported by Hugh Son

Buried in a roughly 200-page quarterly filingfrom JPMorgan Chase last month were eight words that underscore how contentious the bank’s relationship with the government has become.

The lender disclosed that the Consumer Financial Protection Bureau could punish JPMorgan for its role in Zelle, the giant peer-to-peer digital payments network. The bank is accused of failing to kick criminal accounts off its platform and failing to compensate some scam victims, according to people who declined to be identified speaking about an ongoing investigation.

In response, JPMorgan issued a thinly veiled threat: “The firm is evaluating next steps, including litigation.”

The prospect of a bank suing its regulator would’ve been unheard of in an earlier era, according to policy experts, mostly because corporations used to fear provoking their overseers.

JPMorgan’s disclosure about the CFPB probe into Zelle comes after years of grilling by Democrat lawmakers over financial crimes on the platform. Zelle was launched in 2017 by a bank-owned firm called Early Warning Servicesin response to the threat from peer-to-peer networks including PayPal.

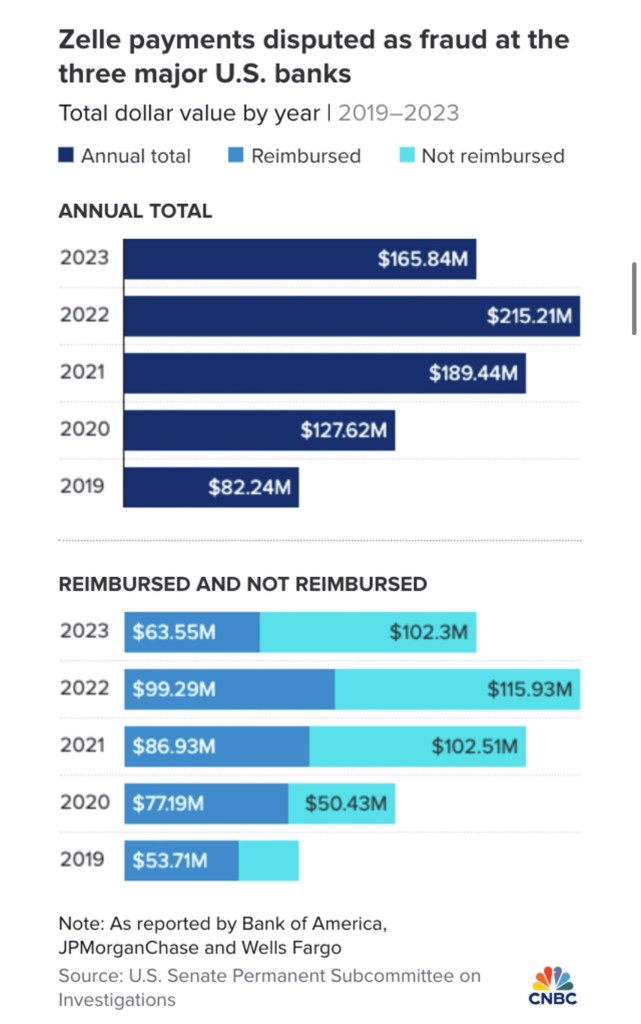

The vast majority of Zelle activity is uneventful; of the $806 billion that flowed across the network last year, only $166 million in transactions was disputed as fraud by customers of JPMorgan, Bank of America and Wells Fargo, the three biggest players on the platform.

But the three banks collectively reimbursed just 38% of those claims, according to a July Senate report that looked at disputed unauthorized transactions.

Read full report: https://www.cnbc.com/amp/2024/09/27/jpmorgan-chase-prepared-to-sue-us-government.html