Reported by Patrick Donachie

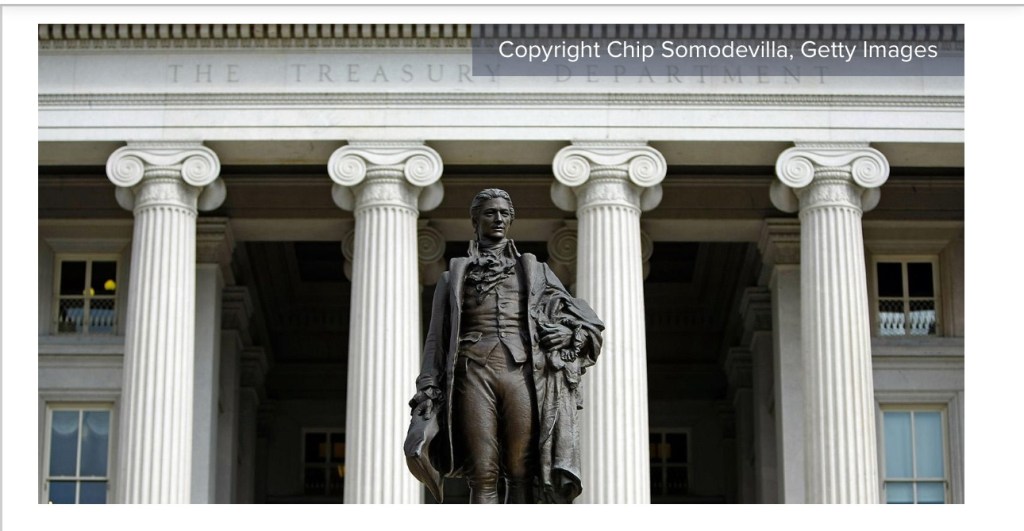

The U.S. Treasury Department finalized new anti-money-laundering rules affecting Securities and Exchange Commission-registered investment advisors, though it loosened some strictures from its proposal earlier this year.

The department’s Financial Crimes Enforcement Network (FinCEN) unveiled two final rules to combat money laundering: one for IAs and exempt reporting advisors and one for residential real estate advisors. Treasury Secretary Janet Yellen said the rules would make it more difficult for criminals to “exploit” these sectors.

“The Treasury Department has been hard at work to disrupt attempts to use the United States to hide and launder ill-gotten gains,” Yellen said. “That includes by addressing our biggest regulatory deficiencies, including through these two new rules that close critical loopholes in the U.S. financial system that bad actors use to facilitate serious crimes like corruption, narcotrafficking, and fraud.”

The finalized rule adds certain RIAs to the “financial institution” definition in the regulations implementing the Bank Secrecy Act. The rule mandates specific standards for anti-money laundering (AML) and countering the finance of terrorism (CFT), including requiring RIAs to report suspicious activity to FinCEN.

The Treasury Department floated proposed rules in February and limited the scope of investment advisors affected; advisors that are “mid-sized,” “multi-state,” and “pension consultants,” as well as RIAs not required to report assets under management (AUM) to the SEC are excluded from the rule. As with the proposal, the rule doesn’t apply to state-registered advisors.

However, those impacted must implement a “risk-based and reasonably designed” AML program, file suspicious activity reports with FinCEN and keep particular records “such as those relating to the transmittal of funds.”

According to the Treasury Department, the new rule will help prevent criminals from laundering money via RIAs, “level the regulatory playing field,” and put U.S. rules in “greater compliance with international AML/CFT standards.”

FinCEN is delegating its examination authority to the SEC, which it says is akin to the SEC’s authority in examining b/ds for compliance with the Bank Secrecy Act’s existing regulations. Firms have until Jan. 1, 2026, to comply. Since mutual funds already fall under the BSA, RIAs would not have to fulfill AML/CFT requirements for those funds they advise.

Read full report: https://www.wealthmanagement.com/regulation-compliance/treasury-department-finalizes-anti-money-laundering-rule-rias