Reported by FinCrime

Do you want to learn how the Sinaloa cartel in Los Angeles conspired with Chinese underground banking groups to launder funds?

Below is an excerpt of the Federal indictment that charged 24 people linked to the organizations following a multi-year investigation dubbed “Operation Fortune Runner,” which unveiled sophisticated methods used by the cartel and its associates to hide and transfer illicit funds.

B. TRADITIONAL TRADE-BASED MONEY LAUNDERING AND CHINESE UNDERGROUND

BANKING

7. Trade-Based Money Laundering

a. Trade-Based Money Laundering (“TBML”) is a system of informal value transfer that exploits legitimate businesses and trade systems to launder the proceeds of illegal activity. TBML in the drug trafficking context operates as follows:

b. Drug trafficking conducted within the United States generates large quantities of U.S. currency (“drug trafficking proceeds”), that must be transferred in some manner to the true owners of that currency, that is, the individuals in other countries who are the sources of the illegal drugs.

c. Drug traffickers and others who commit illegal acts in the United States are aware that banks and other financial institutions are required to file Currency Transaction Reports (“CTRs”) with the Financial Crimes Enforcement Network (“FinCEN”) of the United States Department of the Treasury that include the name and identification of the beneficial owner or owners of those funds for any transaction in U.S. currency in excess of $10,000, and frequently try to evade these reporting requirements.

d. In addition, drug traffickers are alert to the high costs of using the conventional banking system, which could include exchange fees when exchanging dollars for pesos and/or wire transfer fees.

e. In order to evade the high costs of transfer and the government reporting that accompanies the deposit of large amounts of currency into the legitimate banking system, drug traffickers seek other methods of integrating the drug trafficking proceeds they accumulate in U.S. currency into the legitimate financial system so that it can be transferred to the true owners without detection.

f. Criminal actors such as drug traffickers typically employ brokers or “money consolidators” who each operate as an informal bank where drug traffickers can place their accumulated drug trafficking proceeds, typically at lower exchange rates and for lesser fees than those at legitimate financial institutions.

g. Brokers and money consolidators seek out businesses and individuals in other countries who purchase merchandise in the United States and need U.S. dollars to pay for that merchandise.

h. The dollars are sold in the black market for pesos and used to pay the open invoices of the businesses and individuals who have purchased goods in the United States.

i. When the purchased goods are shipped to the country of the purchaser and sold, the proceeds of those sales are then relinquished to the owner of the drug trafficking proceeds in the country where the drugs originated, that is, the drug trafficker whose product generated the U.S. currency, thus enabling the drug trafficker to avoid the physical transfer of currency across the border and the accompanying risks of law enforcement seizure and robbery.

8. Trade in Goods from China Used to Circumvent Restrictions on Taking Funds Out of China

a. The People’s Republic of China (“PRC”) maintains its economic strength in part by imposing a closed system of investment on its citizens. That is, individuals who live, work, or invest in the PRC are generally restricted from transferring more than the equivalent of $50,000 per year out of China. Consequently, many individuals with holdings in China who wish to transfer assets greater than $50,000 in value to the United States seek alternative methods outside the conventional banking system to move their funds. These informal value transfer systems (“IVTS”) require the participation of brokers who buy and sell U.S. dollars in the United States.

b. To transfer funds to the United States, an individual in China contacts a broker with dollars to sell in the United States. The individual in China then transfers the equivalent amount in Chinese currency (renminbi) to an account in China specified by the broker. Once the broker receives electronic confirmation that the amount in question has been moved to the specified account, the

broker arranges for the dollars in the United States to be released to the buyer or to a designated representative of the buyer.

c. The seller of U.S. currency in the United States

obtains dollars in a variety of ways, including by accepting cash from individuals engaged in criminal activity that generates large amounts of bulk currency, such as drug trafficking. The U.S. broker charges a percentage commission as a fee to the owner of the criminal proceeds to conceal the nature and source of the funds.

d. The funds that are transferred in China to the broker are then used to pay for goods purchased by businesses and organizations in Mexico, Colombia, or elsewhere such as consumer goods or items needed to aid the drug trafficking organization to manufacture illegal drugs, for example, precursor chemicals, including fentanyl. Once the goods are sold, generating local currency (for example, Mexican pesos), the proceeds are returned to the drug trafficking organization that provided the dollars in the United States. In this way, the funds from China facilitate the laundering of drug trafficking proceeds from the United States to the source country, while at the same time providing United States dollars to the individual from China who initiated the transaction.

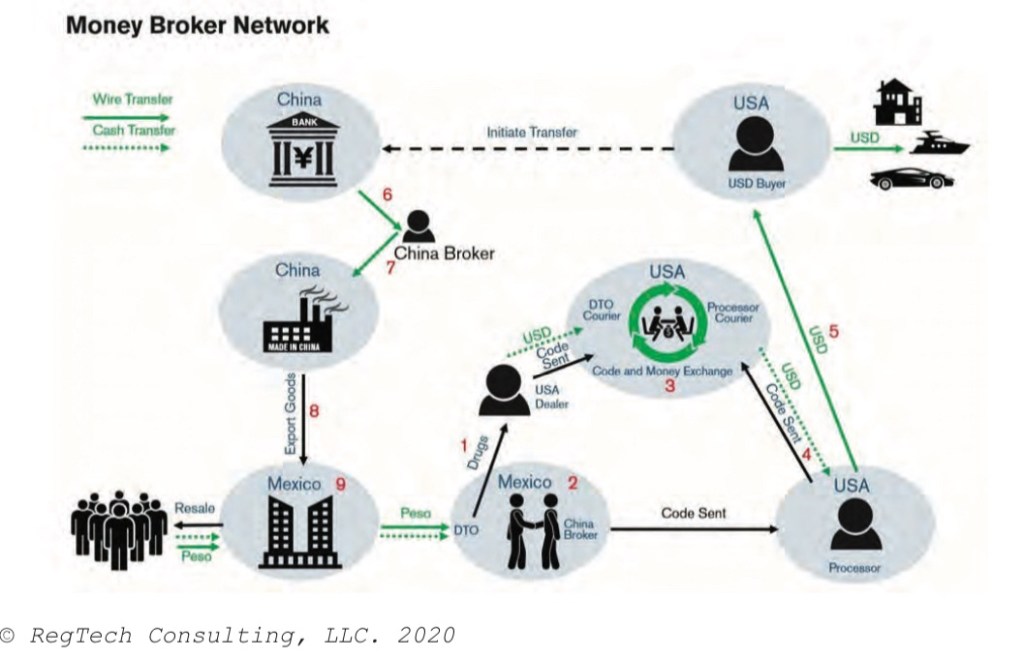

This system is depicted in the below diagram.

e. Because of the many Chinese nationals living in the United States who use this method of transferring their funds from China to the United States, there is a very high demand for United States currency from the Chinese money exchange businesses described above; that demand can easily be met by the DTOs that have drug trafficking proceeds they wish to transform into usable funds available in the traditional banking system.

f. The Chinese money exchange businesses actively solicit and accept drug trafficking proceeds from the DTOs by charging a reduced rate for laundering those proceeds, thereby assisting the DTOs to repatriate their profits, and continue the business of supplying deadly drugs to the United States and other countries.

g. The Chinese money exchange businesses dispose of the drug proceeds by either delivering United States currency directly to their money exchange customers, purchasing real or personal property, including luxury goods and cars to be shipped to China, or using a variety of traditional methods to place the funds into the traditional banking system such as purchasing cashier’s checks, or “structuring,” that is, depositing small amounts at a time into bank accounts opened for this purpose.

Read full DOJ Complaint: https://www.courthousenews.com/wp-content/uploads/2024/06/us-v-martinez-reyes-indictment-central-district-california.pdf