Reported by Romain Dillet

After the Wirecard scandal, Germany’s financial regulator BaFin started to look more closely at young fintech startups that wanted to grow at a rapid pace — it’s better to be safe than sorry.

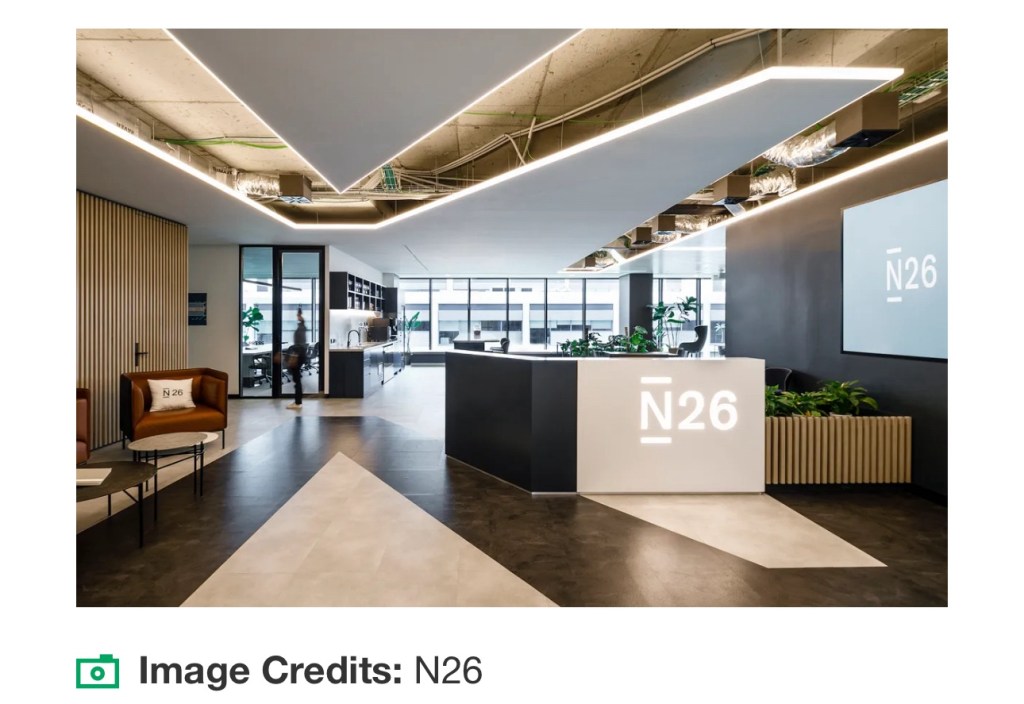

In particular, N26, a Berlin-based banking startup that raised hundreds of millions of euros and quickly became a unicorn, has had a complicated relationship with BaFin for the past few years. The regulator imposed a cap on new signups as a sanction to force the startup to improve its anti-money laundering processes.

This week, N26 announced that BaFin is going to lift the growth restriction starting on June 1, 2024. The cap was originally set in 2021 at 50,000 new customers per month. At the end of 2023, it was increased slightly to 60,000 customers per month.

Last week, as part of the conclusion of this oversight period, BaFin fined N26 €9.2 million (around $10 million at today’s exchange rate) for shortcomings in reporting suspicious activity that occurred in 2022.

Read full report: https://techcrunch.com/2024/05/29/german-financial-regulator-lifts-restrictions-on-n26-signups/