Reported by Consumer Financial Protection Bureau (CFPB)

Fraud in gaming markets

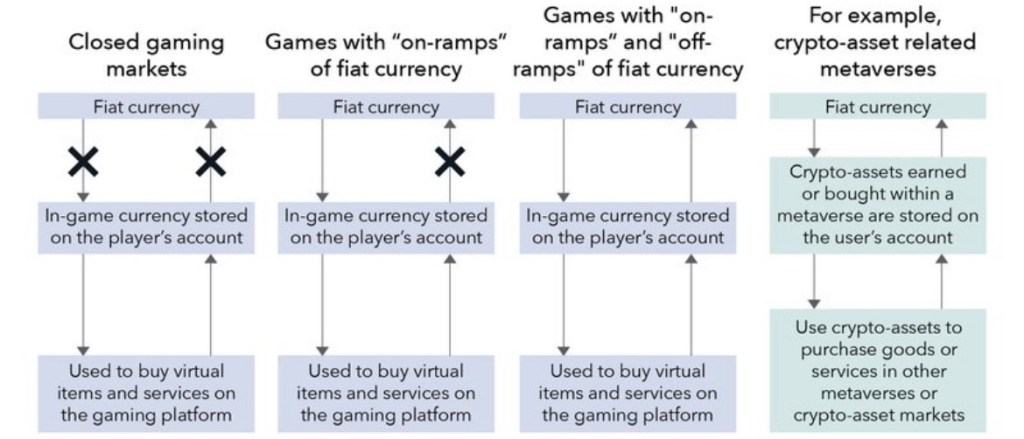

The ability to transfer and otherwise convert gaming assets to fiat currency or crypto-assets has led to a proliferation of money laundering137and fraud138 on gaming platforms.

Researchers and academics have found that gaming markets can facilitate illegal money laundering.139 For example, a person can open different player accounts on several online gaming platforms, use those accounts to buy gaming assets with illegally obtained funds. They can then send the assets to other accounts within the game and then convert them to fiat currency using third-party markets. These practices enable ill-gotten funds to become less traceable with each step.140

Further, the conditions of gaming markets embolden activities such as fraudulent transactions and scams. In 2023, one firm estimated that it lost $110 million due to fraudulent transactions.141 The CFPB has received complaints regarding various trade scams on these third-party websites. In one complaint, a consumer reports that they purchased a gaming account from a prominent third-party website and confirmed receipt of the account. However, once receipt was confirmed, the account was hacked and recovered by the original owner. Per the third-party website’s terms and conditions, once receipt was confirmed, there was no available recourse for the buyer.142

Issues with third-party systems

The terms and conditions of these third-party websites can be misleading or otherwise obscure the truth about the risks involved in their services. For example, some third-party websites entice users with gaming assets, like discounted bundles of game currency or rare virtual items, in exchange for downloading applications, watching advertiser content, or submitting personal details.143 These tactics potentially expose players to risks like credit card fraud, malware, and identity theft. 144

Several of these third-party websites collect a large amount of personally identifiable information including email addresses, gaming usernames, and log data, such as IP addresses and browser information. They may also need banking information to process payments through services like Stripe and PayPal.145 Yet, these marketplaces have had a number of data breaches and hacks.146 These incidents have also occurred at large gaming companies, pointing to an industry-wide security issue.147As these markets evolve, including functioning more and more like banking and payment systems, it is imperative that companies take appropriate data security steps.148

Gaming specific financial products

Leveraging the value of gaming assets and the amount of commerce occurring on gaming platforms, some companies have begun exploring gaming-specific services that resemble traditional financial products. For example, J.P. Morgan recently expressed interest in an “embedded payment ecosystem” for gaming, meaning a “wallet, that can serve as a central hub for anything related to a player: gaming credentials, in-game currency balances and transactions and spending history.”149 J.P. Morgan Payments has also provided strategic investment to Tilia, a payment processer and subsidiary of Linden Lab.150 Tilia was created to provide financial services to virtual worlds in the form of in-game transactions, payouts to creators, and conversions of in-game currencies to fiat currency, including USD. “Tilia is currently partnered with several virtual worlds, online games, and NFT marketplaces, including Second Life, Upland and Avatus.”151

Similar products have also emerged by technology companies. ZELF launched in the US in June 2022 as a banking service for virtual worlds with the intention of easing the transfer of money between the online world and the offline world, as well as trading gaming assets between players.152 This was done through an instant and virtual Visa credit card secured by a deposit account, known as a ZELF Account, that could be opened within 30 seconds using only the applicant’s name, email, and phone number.153 Once issued, users could deposit crypto-assets, NFTs, and gaming assets to then be converted into fiat currency.154 Additionally, ZELF’s marketing suggests that its intended target audience was Gen Z and young people.155According to reporting, the ZELF Account aimed to provide young people the ability to facilitate borrowing against gaming assets by holding game currency in escrow and providing players with payday loans.156 The ZELF Account157 was shut down within two days of publicly launching.158

In 2023, MetaLend announced a program that would allow “Axie Infinity players to take out loans against their in-game crypto-based assets.”159 Further, in 2022, an international technology company offered a two-year loan for approximately $30,000 to a Decentraland gamer. The loan was used to purchase digital land in the crypto-based virtual world and many reports at the time referred to the loan as the first mortgage of the metaverse. In the loan, the technology company owned the land and the borrower had to pay monthly payments to use the land. Once paid, the land would transfer to the borrower.160

The role of banks and consumer finance products within gaming is evolving, but there appears to be a trend towards introducing services that are similar to traditional consumer financial products that rely on the value of gaming assets and the digital transactions that are happening on gaming platforms.

Read full report: https://www.consumerfinance.gov/data-research/research-reports/issue-spotlight-video-games/#conclusion