Reported by The Crown Prosecution Service

An ex-takeaway worker has been convicted (Wednesday 20 March 2024) of laundering the proceeds which saw her rise from living above a Chinese restaurant to residing in a multi-million pound house in an affluent part of North London.

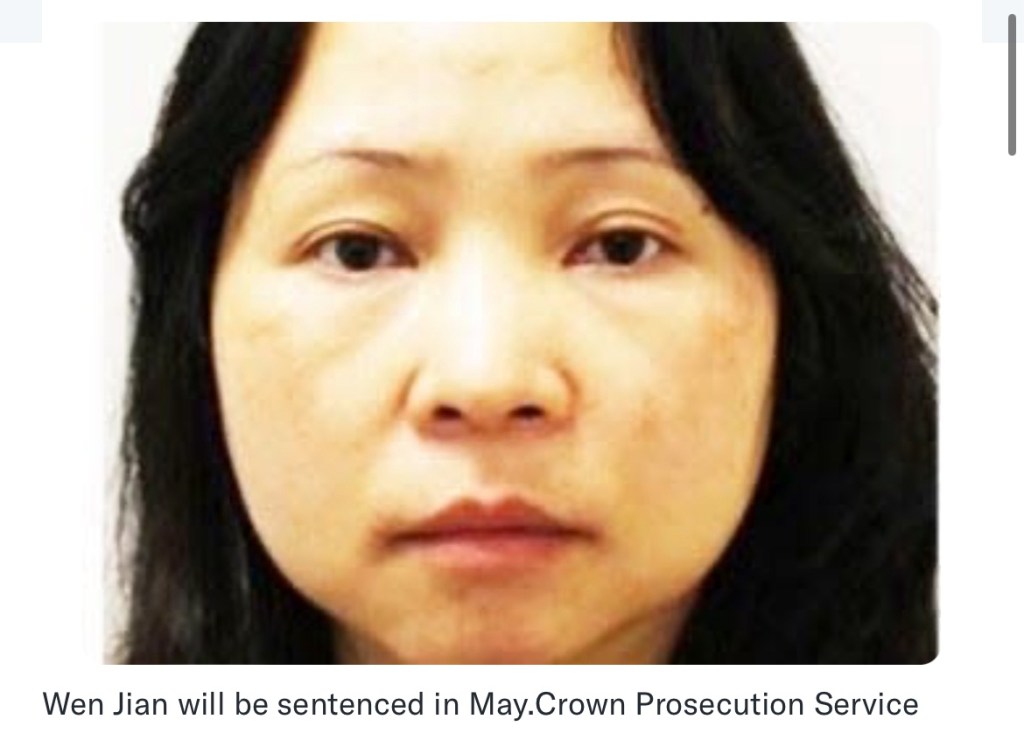

Jian Wen, 42, was found guilty at Southwark Crown Court of an offence relating to money laundering.

A Metropolitan Police investigation resulted in the CPS seizure of Bitcoin wallets from Wen, with an initial estimated value in excess of £2 billion. Prosecutors told the court the sheer scale of the seized Bitcoin, the lack of any legitimate evidence for how it was acquired and its connection to a massive investment fraud in China, all indicated that it was criminal property. The original fraud and acquisition of the Bitcoin was undertaken by another suspect who is yet to be arrested and brought before the court. Wen was involved in converting significant amounts of Bitcoin into cash and other expensive assets, on behalf of the international fraudster.

Prior to working for her “employer”, Wen lived a modest lifestyle in Leeds, with declared earnings in 2015 and 2016 of just £12,800 and £5,979. Her fortune changed significantly when she met the fellow Chinese national who was the source of the Bitcoin.

In 2017, they moved into a six-bedroom property in London, at a rental cost of over £17,000 each month. The two women presented themselves as successfully operating an international jewellery business, with Wen operating as the English-speaking and apparently legitimate front person for her employer. Wen was later joined by her young son, who moved from China to attend a private school in the UK, benefitting from her newly affluent lifestyle. Wen later stated that she had been gifted 3,000 Bitcoin, then valued at approximately £15 million, by her employer.

Between Autumn 2017 and late 2018, Wen made efforts to purchase properties in London, valued at £4.5 million, £23.5 million, and £12.5 million. She was hampered by difficulties converting sufficient Bitcoin into Sterling and by “know your customer” questions asked of her under anti-money laundering regulations. When challenged about the source of the proposed funding for the property purchases, Wen claimed it came from legitimate sources including Bitcoin mining, a claim that was ultimately not accepted by those she instructed to assist with the sale.

Between 2017 and 2019, Wen also travelled abroad extensively, throughout Europe and elsewhere, largely enabling the conversion of large amounts of Bitcoin into more tangible assets. A receipt addressed to Wen, for example, showed jewellery worth tens of thousands of pounds had been purchased in Zurich. In 2019, she travelled to Dubai, arranging to view a number of properties for sale. In October and November of that year, she went on to purchase two properties in Dubai. Their value in total amounted to more than £500,000.

Throughout the course of the investigation and subsequent trial, Wen denied knowing that any of the Bitcoin was derived from criminality and had no suspicions about its scale.

The CPS Proceeds of Crime Division used its civil powers to obtain a Property Freezing Order from the High Court against Wen whilst it undertakes a non-conviction-based civil recovery investigation. That investigation could result in the forfeiture of the seized Bitcoin regardless of whether Wen or the other suspect are convicted.

Read full report: https://www.cps.gov.uk/cps/news/specialist-cps-team-involved-uks-largest-bitcoin-seizure