Reported by the Athennian Team

list the ultimate, natural owners of assets. These registries address the problem of understanding who happens to own, control, and influence a large asset, namely a company or a property. Oftentimes, criminals are known to secretly own or control shares in companies where they use these entities to launder stolen money. As of March 2024, there are 149 countries worldwide that have committed to beneficial ownership registries, and there are also global standards for beneficial ownership collection and disclosure set by the Financial Action Task Force to which countries must adhere. As beneficial ownership registries have a principal aim to combat money laundering, fraud, and terrorist financing, countries are requiring that information must be accurate, adequate, and timely for access by competent authorities (e.g., Financial Intelligence Units or FIUs) and law enforcement.

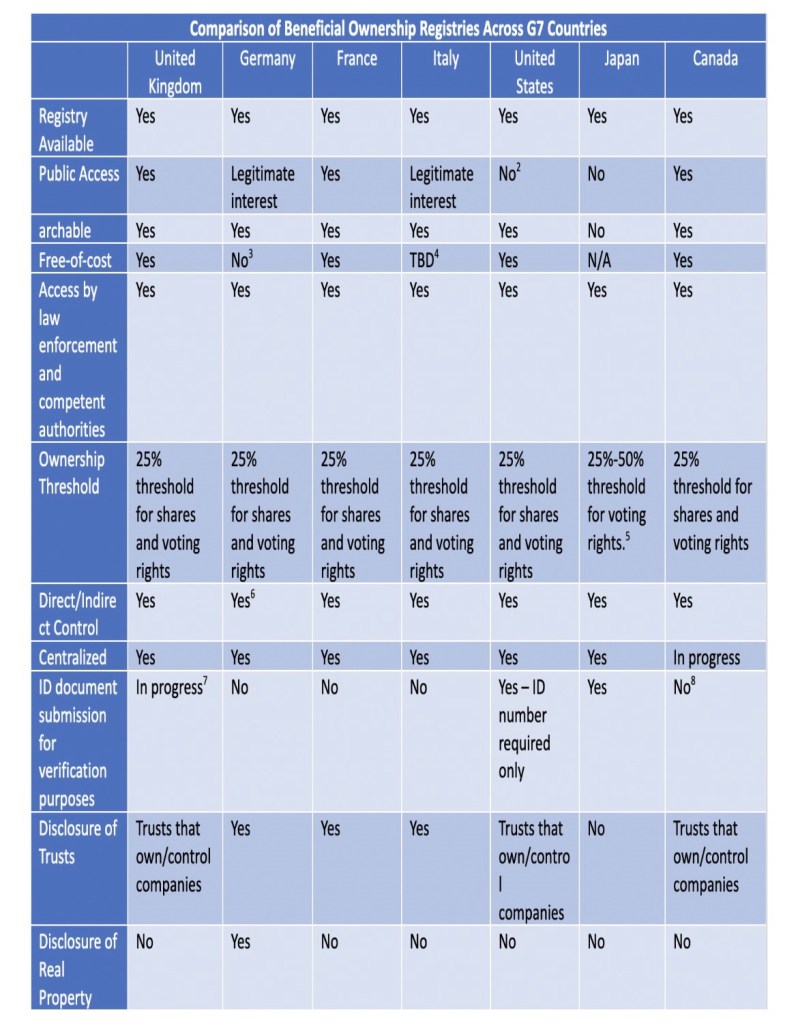

The table below provides a comparison of features for beneficial ownership disclosure regimes across G7 countries: The United Kingdom (UK), Germany, France, Italy, the United States (US), Japan, and Canada.

Legend

N/A: Not Applicable/Available.

TBD: To Be Determined.

In progress: Policy/Legislative commitments have been enacted and awaiting implementation.

Legitimate interest: Prospective users are required to prove to the registrar they have a legitimate interest to be able to search the registry and access data. Legitimate interest criteria vary according to each jurisdiction.

Read full report: https://www.athennian.com/post/snapshot-of-beneficial-ownership-registries-in-g7-countries