Reported by SETH MOREHEAD

Fort Worth-based Agridime LLC has been put into receivership by a successful complaint from the Securities and Exchange Commission (SEC).

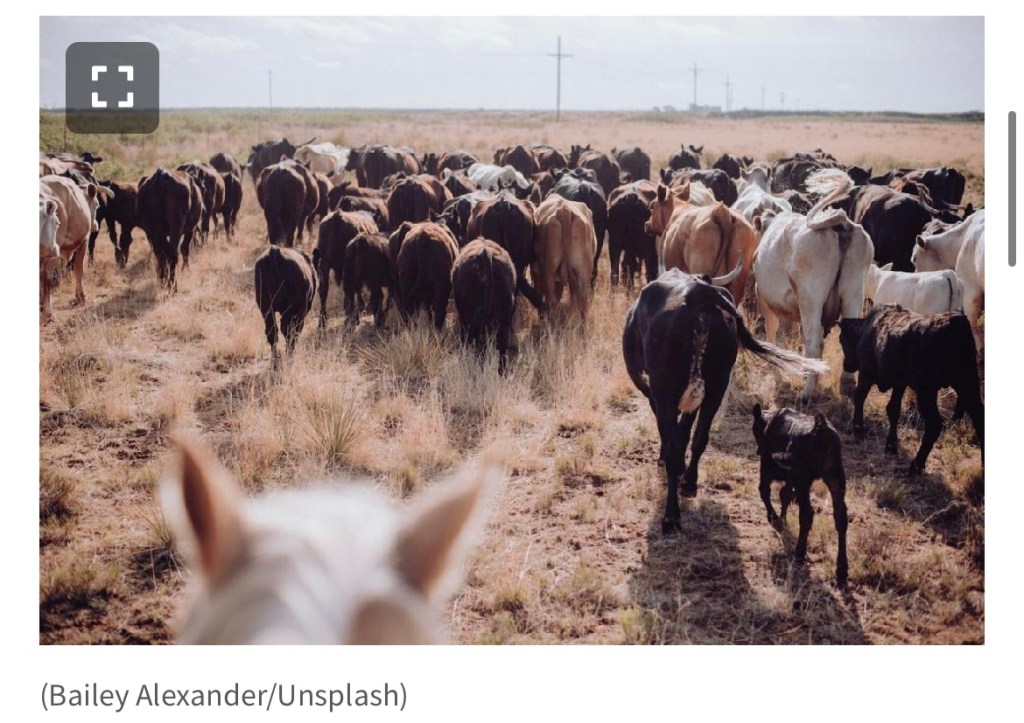

The SEC obtained a temporary restraining order, an asset freeze, the appointment of a receiver, and other emergency relief against Agridime on December 14, alleging an ongoing $191 million Ponzi scheme raised from more than 2,100 investors in at least 15 states since 2021. Agridime sold cattle contracts that promised investors 15 to 32 percent returns by raising and selling cattle from its network of ranches.

The complaint was filed on December 11 and unsealed on December 13 in the United States District Court for the Northern District of Texas, Fort Worth Division.

“The defendants enticed investors with guarantees that they could ‘make money raising cattle without having to do all the work,’ but as we allege in our complaint, their promises of annual returns of 15‑32 percent were, in the defendants’ own words, ‘too good to be true,’” said Eric Werner, Director of the SEC’s Fort Worth Regional Office.

Agridime was founded in 2017 by Josh Link of Gilbert, Arizona and Jed Wood of Fort Worth. Both men each own a 45.5 percent interest in Agridime.

The company specializes in meat sales, distribution, and animal supply chain management, and operates in Texas, Arizona, Kansas, North Dakota, as well as other states. Contracts sold by the company promised the sale of cattle at $2,000 per calf to the investor and buying the cattle back after a year, providing the investment return.

The complaint alleges that Agridime used at least $58 million of investor funds that were supposed to be used to run their cattle operations to execute Ponzi payments to existing investors. “Defendants did not buy the number of cattle required to fulfill the Company’s obligations under the Cattle Contracts, and as a result, Agridime has only been able to return principal and pay promised returns by making Ponzi payments.”

Agridime also did not disclose the ”Ponzi payments” when soliciting new investors, and did not disclose that an additional $11 million was used to pay the 10 percent commission to the company’s salesmen, including the owners Link and Wood and Link’s wife.

Sales commissions were never disclosed to investors through Agridime’s financial summary on its website, its advertisements, or its cattle contracts.

The company had gotten into trouble with the states of Arizona and North Dakota earlier this year, resulting in it receiving cease-and-desist orders. Agridime violated those orders by continuing to sell more than $10 million in securities in unregistered transactions in both states.

The SEC is seeking permanent injunctive relief and disgorgement of ill-gotten gains, plus prejudgment interest and civil penalties.

As of September, Agridime’s cattle contracts required them to pay investors more than $123 million in principal as well as $24 million in profits, while only having $1.5 million in cash reserves at the end of September.