Reported by Lockridge Okoth

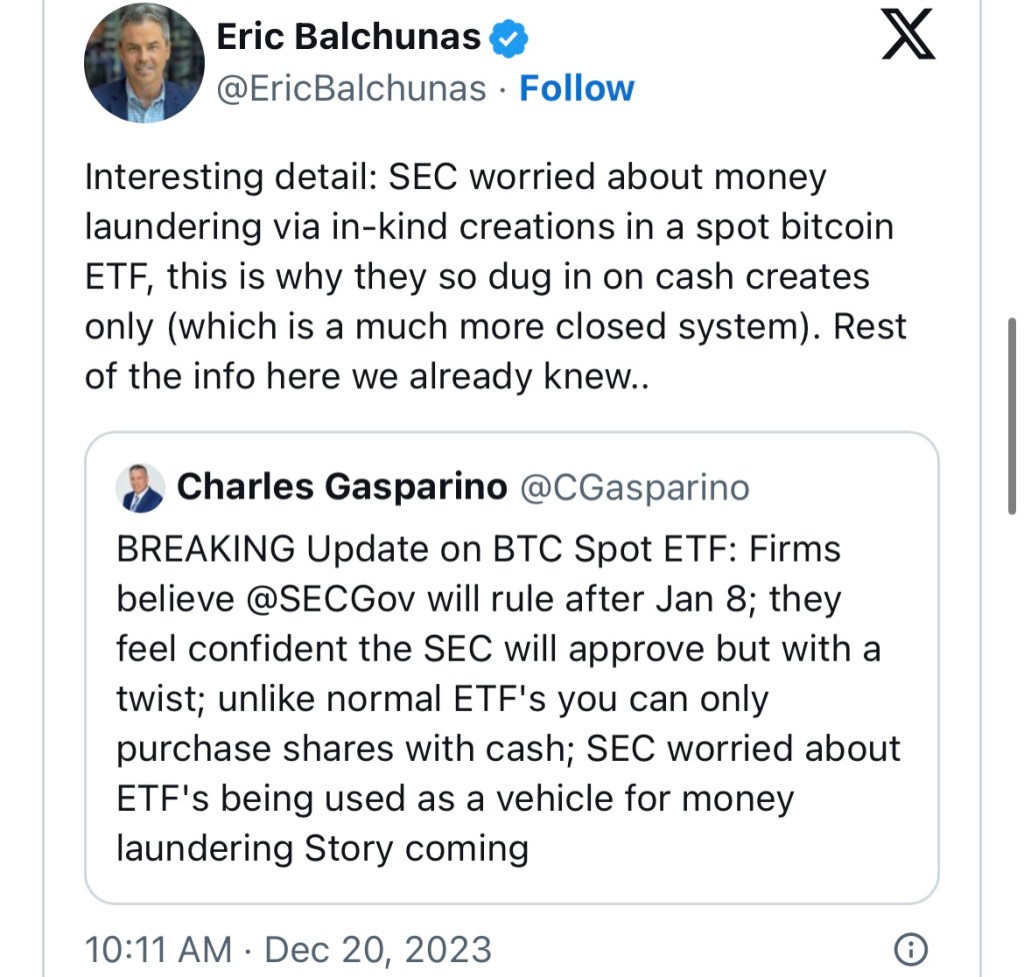

Amid ongoing spot Bitcoin exchange-traded funds (ETFs) race, the US Securities and Exchange Commission (SEC) has been engaging with the institutional players in the race for approvals. By and large, the plain message has reportedly been that the ETFs do cash creates or wait, according to ETF specialist with Bloomberg Intelligence, Eric Balchunas in a recent post.

SEC possibly pushing for cash creates over money laundering concerns

The US “SEC [is] worried about ETFs being used as a vehicle for money laundering,” according to Charles Gasparino, senior correspondent with Fox Business News. His comments come amid a pronounced push from the financial regulator, that filers’ ETF products only do cash redemptions and not crypto redemptions.

Evidence of this is the recent series of amendments where multiple firms, including Invesco, BlackRock, Ark Invest 21Shares, Valkyrie, and Fidelity have indicated having embraced cash creates.

Cash creates, which is a “much more closed system,” according to Balchunas, would require that the customer gives the issuer cash for new ETF shares, and then the issuer buys Bitcoin. Conversely, for in-kind creates, the customer gives the issuer BTC in exchange for the ETF shares.

Increasing demand for a BTC ETF would therefore prompt an intermediary (“the AP”) to create new ETF shares. Ultimately, this would mean that either way new ETF shares translate to new Bitcoin purchase.

In a recent post, Balchunas indicated that the SEC is pushing for cash redemptions because it would mean only the ETF issuer handles Bitcoin and not the intermediaries, who could be registered and/or unregistered broker dealers.

Also Read: SEC demands ‘cash creates or you will wait’

Read full report: https://www.fxstreet.com/amp/cryptocurrencies/news/sec-allegedly-concerned-about-money-laundering-via-in-kind-creates-in-a-spot-btc-etf-202312201900