Reported by Chanyaporn Chanjaroen and Low De Wei

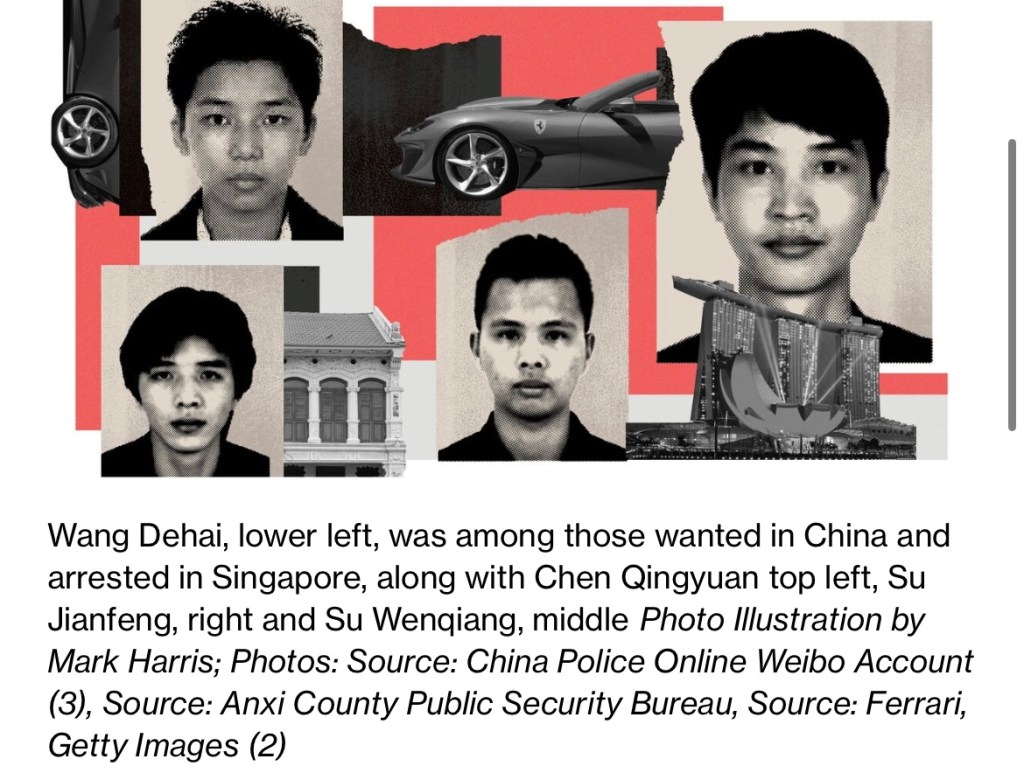

Wang Dehai was already on the run when he made Singapore his home five years ago. Police in China were offering a bounty for information about him for his alleged role in an illegal gambling ring.

Once in Singapore, Wang and his wife set up a family office and he got an employment pass, giving him the right to stay in the city-state. They banked with Credit Suisse, and the couple got passports from the tax haven of Cyprus. Wang, 34, splurged on a S$23 million ($17.2 million) condominium in the prime Orchard area and held about $2.8 million in cryptocurrency.

Wang’s idyllic world came crashing down in August when he was among 10 people of Chinese origin arrested and charged in the biggest money-laundering case the nation has ever seen. Authorities have seized more than S$2.8 billion in assets including gold bars, jewelry, 62 cars and 152 properties. The tally may rise, with many suspects still on the loose.Assets seized or issued with prohibition of disposal orders in anti-money laundering probe.

The seizures have sent shockwaves through the orderly nation, prompting a review of the policies that were exploited to allow so much money to allegedly be laundered for so long at some of the world’s biggest banks. The police raids across the toniest neighborhoods also highlight how Singapore is paying the price for its open borders just as some wealthy Chinese with suspected tainted funds are looking for places to park their money.

“There was enough risks or obvious questions to require much more rigorous and significant due diligence to be done on the provenance of these people and their money,” said Christopher Leahy, the Singapore-based managing director of Blackpeak (Holdings) Ltd., a research and risk advisory firm.

For decades, Singapore has taken steps to attract the uber rich, spawning a finance industry that’s made it one of the wealthiest countries on earth. Generous tax incentives and programs that offer pathways to long-term residency have paid off handsomely, prompting billionaires from James Dyson to Ray Dalio to set up family offices. Assets overseen by the money management sector have almost doubled in seven years to $3.65 trillion, with about three-quarters of that from abroad.

More recently, a wave of Chinese investors has arrived, fleeing strenuous pandemic restrictions and crackdowns that hit industries from technology to real estate. Singapore is a natural choice for them, as ethnic Chinese make up about three-quarters of the population and Mandarin is widely spoken. Since 2019, direct investment from mainland China and Hong Kong has risen 79% to S$19.3 billion. Private wine bars and country clubs have benefited from the surge in spending.

The surprise sting operation is now prompting a rethink of all this, amid signs dirty money is joining legitimate businesses in the rush to Singapore, with cash winding up at global lenders from Credit Suisse to Citigroup Inc.

The policies drawing scrutiny include family office programs after the government said at least one of the accused may have set up an office that was awarded tax incentives. In all, the 10 accused have at least five family offices among them, according to documents reviewed by Bloomberg News, and people familiar with the matter. It’s not clear whether all five received tax breaks. More than 1,100 clans from around the world have created these vehicles in Singapore to manage their fortunes as of the end of 2022, an almost threefold increase from 2020.

Many of the accused also invested in existing companies or set up their own businesses to establish ties. Wang Dehai, for example, whose employment pass is valid through June 2024 according to manpower ministry records, invested in Delibowl Pte, a Chinese restaurant chain, records show.

Read full report: https://www.bloomberg.com/news/articles/2023-12-04/how-suspects-spent-billions-in-singapore-s-biggest-money-laundering-case