Reported by PASCAL HANSENS, SIGRID MELCHIOR, MAXENCE PEIGNÉ AND HARALD SCHUMANN

Investigation

Since Russia’s invasion of Ukraine in February 2022, the 27 EU countries have adopted 11 sanction packages, targeting all kinds of raw materials such as oil, coal, steel and timber.

But raw materials that the EU considers “critical” or “strategic” — 34 in total — still flow freely from Russia to Europe in vast quantities, providing crucial funds to state enterprises and oligarch-owned businesses.

While some of its western allies have targeted Russia’s mining sector — the UK recently banned Russian copper, aluminium and nickel — the EU has continued its imports.

Airbus and other European companies are still buying titanium, nickel, and other commodities from firms close to the Kremlin more than a year after the invasion, Investigate Europe can reveal.

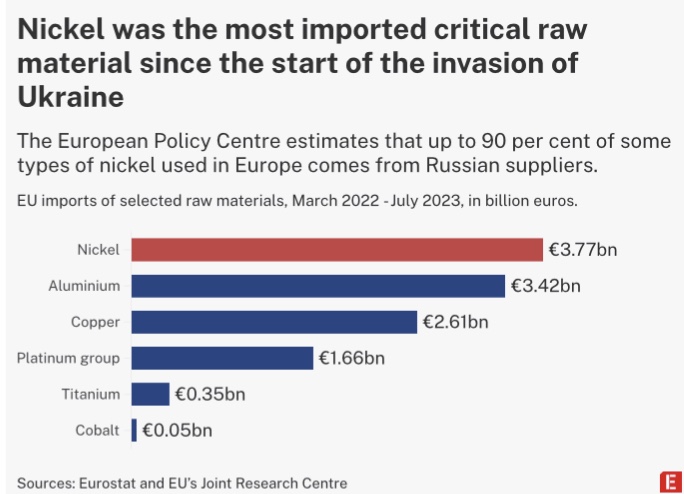

Between March 2022 and July this year, Europe imported €13.7bn worth of critical and strategic raw materials from Russia, data from Eurostat and the EU’s Joint Research Centre shows.

More than €3.7bn arrived between January and July 2023, including €1.2bn of nickel. The European Policy Centre estimates that up to 90 percent of some types of nickel used in Europe comes from Russian suppliers.

“Why are critical raw materials not banned? Because they are critical, right. Let’s be honest,” the EU’s special envoy for sanctions, David O’Sullivan, pithily said at a September conference.

Russian critical raw materials still flow freely into the EU

The EU is desperate for critical raw materials to achieve its aim of climate neutrality by 2050. These commodities are crucial for electronics, solar panels and electric cars, but also for traditional industries like aerospace and defence. Yet they are all too often in scarce supply, unevenly available across the globe, and in high demand.

“The war in Ukraine has clearly shown the willingness of Russia to weaponise the supply of key resources. As Europeans, we cannot tolerate that,” says Henrike Hahn, a German Green MEP working on the new Critical Raw Materials Act.

Loopholes

Europe’s imports not only fund Russia’s war economy, but also benefit Kremlin-backed oligarchs and state companies. Although the EU has targeted some shareholders, Russia’s mining businesses have faced no restrictions.

The loophole is even more glaring that the US and the UK sanctioned several firms directly, further isolating the EU in its double standards.

Analysis of Russian customs data shows that Vsmpo-Avisma, the world’s largest titanium producer, sold at least $308m [€290.5m] of titanium into the EU via its German and UK branches between February 2022 and July 2023. It is part-owned by Russia’s national defence conglomerate, Rostec.

The two companies share the same chairman: Sergei Chemezov, a close Putin ally. The pair were KGB officers in East Germany in the 1980s.

Both Chemezov and Rostec are under EU sanctions and helped supply tanks and weapons to the Russian army. Brussels has not sanctioned Vsmpo-Avisma directly, but the US did ban exports to the firm on 27 September, saying it was “directly involved in producing and manufacturing titanium and metal products for the Russian military and security services.”

Among Vsmpo-Avisma’s largest European customers is Airbus, the aerospace giant partly owned by the French, German and Spanish states.

Between the start of the war and March 2023, Airbus imported at least $22.8m worth of titanium from Russia; a fourfold increase in value and tonnes compared to the previous 13 months.

Read full report: https://euobserver.com/world/157586