Reported by Rebecca Burns

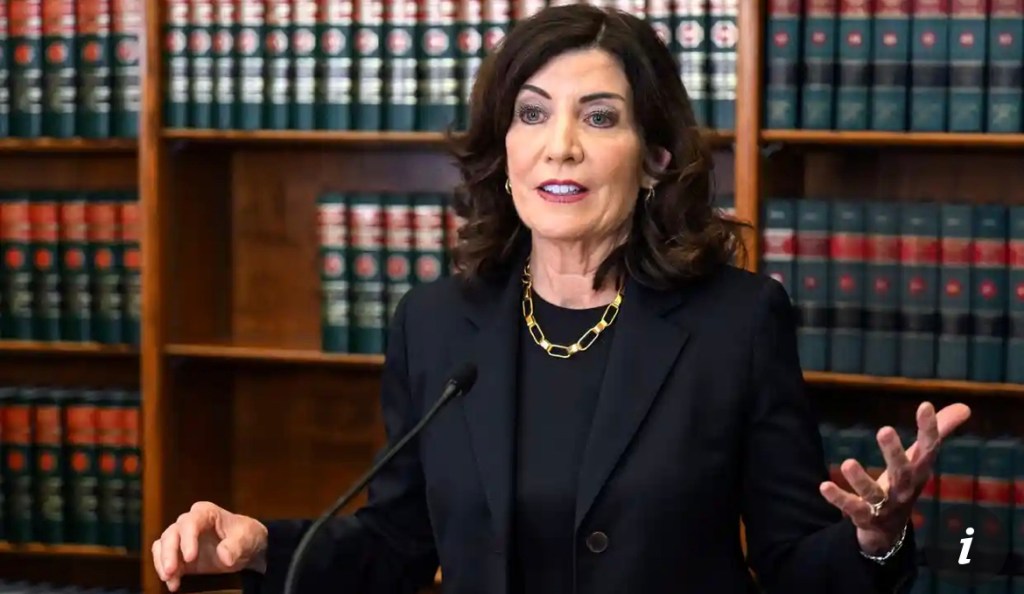

A corporate lobbying group backed by Koch Industries is quietly pressing the Democratic New York governor Kathy Hochul not to sign a landmark transparency bill unmasking the owners of shell corporations involved in financial crimes, wage theft and tenant abuses.

High-profile real estate donors to Hochul’s campaign also oppose new disclosure requirements for limited liability companies, or LLCs, a notoriously opaque corporate structure that can thwart attempts at both civil and criminal law enforcement by concealing owners’ true identities.

Hochul has yet to say whether she’ll sign the bill, passed by the New York legislature in June, requiring LLCs to report that information – and creating a first-in-the-nation database providing public access to it.

Since taking office in 2021, Hochul has accepted nearly $2.1m in campaign contributions from real estate and other companies registered as LLCs, according to a Guardian review of state records.

While many businesses incorporate as LLCs to take advantage of perfectly legal tax benefits and liability protections, federal anti-money-laundering authorities call the entities “inherently vulnerable to abuse”. As such, they’re often the vehicles of choice for money launderers, tax cheats and a host of other actors seeking to remain in the shadows.

High earners create fake companies with no purpose other than to move money and dodge income taxes. Bad bosses attempt to hide serial wage theft within an alphabet-soup of subsidiaries. Anonymous owners are especially pervasive in the real estate market, where foreign oligarchs stash their ill-gotten cash in luxury condos and high-profile property owners obscure their business dealings through a web of difficult-to-trace entities.

Read full report: https://amp.theguardian.com/us-news/2023/oct/22/kathy-hochul-new-york-finance-real-estate-shell-corporations-llcs